Big Government Socialism Bill and Small Businesses

INTRODUCTION

The pandemic has had a sizable impact on most small businesses. Their smaller scale, specialized activities, and constrained access to capital meant that government mandated shutdowns would cause greater damage to these enterprises relative to large businesses. To offset those potential impacts, the federal government in the spring of 2020 quickly created and implemented the Paycheck Protection Program (PPP) while expanding the funding for Economic Injury Disaster Loans (EIDL). More than $800 billion was allocated to assist small businesses during the pandemic. In the first fourteen days of PPP, the equivalent of fourteen years of Small Business Administration (SBA) loans were approved. Estimates by Faulkender, Jackson, and Miran (2020) indicate that nearly 20 million American jobs were saved as a result of the speedy implementation by the Trump Administration. According to the Council of Economic Advisers, these efforts greatly mitigated the bankruptcies we would normally expect to observe from a shock of the pandemic’s magnitude. Bankruptcy filings from July through October of 2020 were 34 percent lower than the peak numbers seen during the 2009 financial crisis (CEA, 2021).

Many small businesses have weathered the storm, but congressional Democrats and the Biden Administration are looking to inflict a new round of damage on America’s small businesses with their massive spending package. Despite record job openings, backers of the bill seek to shrink the size of the American workforce, making it more difficult for small businesses to find the workers they seek. The proposed legislation also imposes costly new mandates and actively disincentives growth.

HIRING

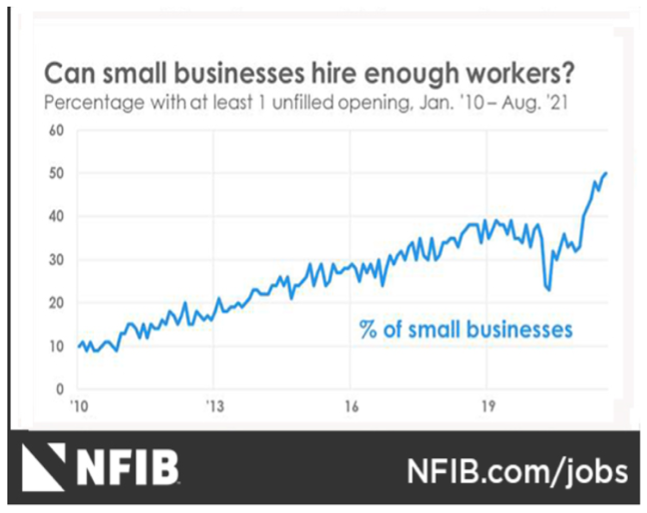

According to the latest surveys from the National Federation of Independent Business (NFIB), the biggest problem small businesses currently face is their ability to hire. In their August 2021 jobs report (NFIB, 2021), a record high “fifty percent of all small business owners reported job openings they could not fill in the current period”.

The reason for this difficulty is because (1) many workers were making more money on enhanced unemployment benefits than they would have earned from full-time employment (an issue economists call “moral hazard”) and (2) households are very liquid from the variety of payments they have and continue to receive from the government. Harvard Economist Raj Chetty has argued there is an important distinction between moral hazard and liquidity when explaining the impact of unemployment insurance (Chetty, 2008). Moral hazard arises when individuals alter their behavior due to poor incentives.

This was the argument over enhanced Unemployment Insurance (UI) benefits—people had to choose between working and getting temporarily elevated UI benefits. For someone receiving $600 per week in UI or $600 per week from working, they would realize the same $2,400 per month of income, irrespective of whether they worked. For some people, receiving the same amount of money from working as from not working will lead them to forego employment and take UI.

A liquidity effect arises if a household has such a higher level of available wealth that their choice between labor and leisure changes. Someone with $5,000 in their bank account may be less willing to work this month than someone with only $50. Taking your checking account balance from $50 to $2,450 due to employment this month is different than taking it from $5,000 to $7,400. If their current liquidity level covers their expenses, at least in the short run, a person is more likely to be currently unemployed.

If the issue is moral hazard, the employment shortages we have observed the last few months are likely behind us because enhanced unemployment benefits ended in September. Early data does not reveal clear differences in employment patterns between states that ended unemployment benefits over the summer relative to those that waited until Labor Day, which could be an indication that the liquidity effect is dominant. To the extent that the accumulated cash reserves from unemployment benefits, other federal stimulus, and ongoing expanded Child Tax Credit payments without work requirements are allowing households to make ends meet without rushing to find a job, the hiring problems for small businesses are likely to persist until those cash reserves return to more typical pre-COVID levels.

As Larry Summers has pointed out, since the beginning of the pandemic, household checking and savings account balances have risen from $11.4 trillion to $14.5 trillion, a 28 percent increase (Federal Reserve, 2021). Personal income has been higher than before the pandemic and savings rates skyrocketed during the shutdowns. While UI explains part of this increased personal income, it also arose from the three sets of economic impact payments and larger child tax credits.

Due to households being more liquid right now, fewer Americans are looking for work. September 2021 actually saw a decline in labor force participation rate. The big government socialism bill in front of the Congress would likely make this labor force reduction permanent. The bill enacts or expands the following:

- Refundable child tax credit

- Free community college tuition

- Expansion of Affordable Care Act subsidies

- Free preschool for 3- and 4-year-olds

Married couples making up to $150,000 per year would be paid $300 per month per child through 2025 under the Biden proposal. A family with three children would receive an additional $10,800 per year from the government, irrespective of whether none, one, or both parents work. This additional income, coupled with the 25 percent increase in SNAP benefits that took effect in October, reduces the incentive for both parents to be employed (Khalil & Boak, 2021).

Likewise, “free” community college decreases the need for people to work part-time while attending school, instead pushing higher education costs onto taxpayers. Expanded government healthcare lowers the likelihood that adults will take a job in order to obtain health insurance benefits for their family. While universal preschool may increase the time available to some parents to work, others will find that the reduction in their expenses plus the other government payments eliminate the need to generate such income from working.

According to new work by Corinth, Meyer, Stadnicki, and Wu (2021), the Biden Child Tax Credit conversion to a de facto universal basic income program without work requirements “reduces the return to working at all by at least $2,000 per child for most workers with children.” They estimate that “this change in policy would lead 1.5 million workers (constituting 2.6% of all working parents) to exit the labor force.” In other words, once one incorporates the effect of the incentives to work from the proposed increase and refundability of the child tax credit contained in the proposed legislation, there would be 1.5 million fewer Americans looking to work. At a time when small businesses are struggling to hire, we can ill afford removing 1.5 million prime-age adults from the labor pool.

Casey Mulligan estimates the overall employment effects of the massive spending package and finds that the “implicit employment and income taxes … would reduce full-time equivalent employment by about 4.5%, or about 7 million jobs” (Mulligan, 2021).

America determined decades ago that government subsidized non-participation in the labor force was appropriate for senior citizens who were eligible for Social Security. Likewise, those deemed permanently disabled do not have to work to receive benefits. However, these latest policy moves act as an opening salvo to fundamentally rupture the social compact by exempting able-bodied, prime-age adults from the labor force. Hardworking Americans will undoubtedly want to weigh in regarding whether honoring work is still an integral part of America’s identity and whether able-bodied, prime-age adults should be expected to work as a condition of receiving government benefits.

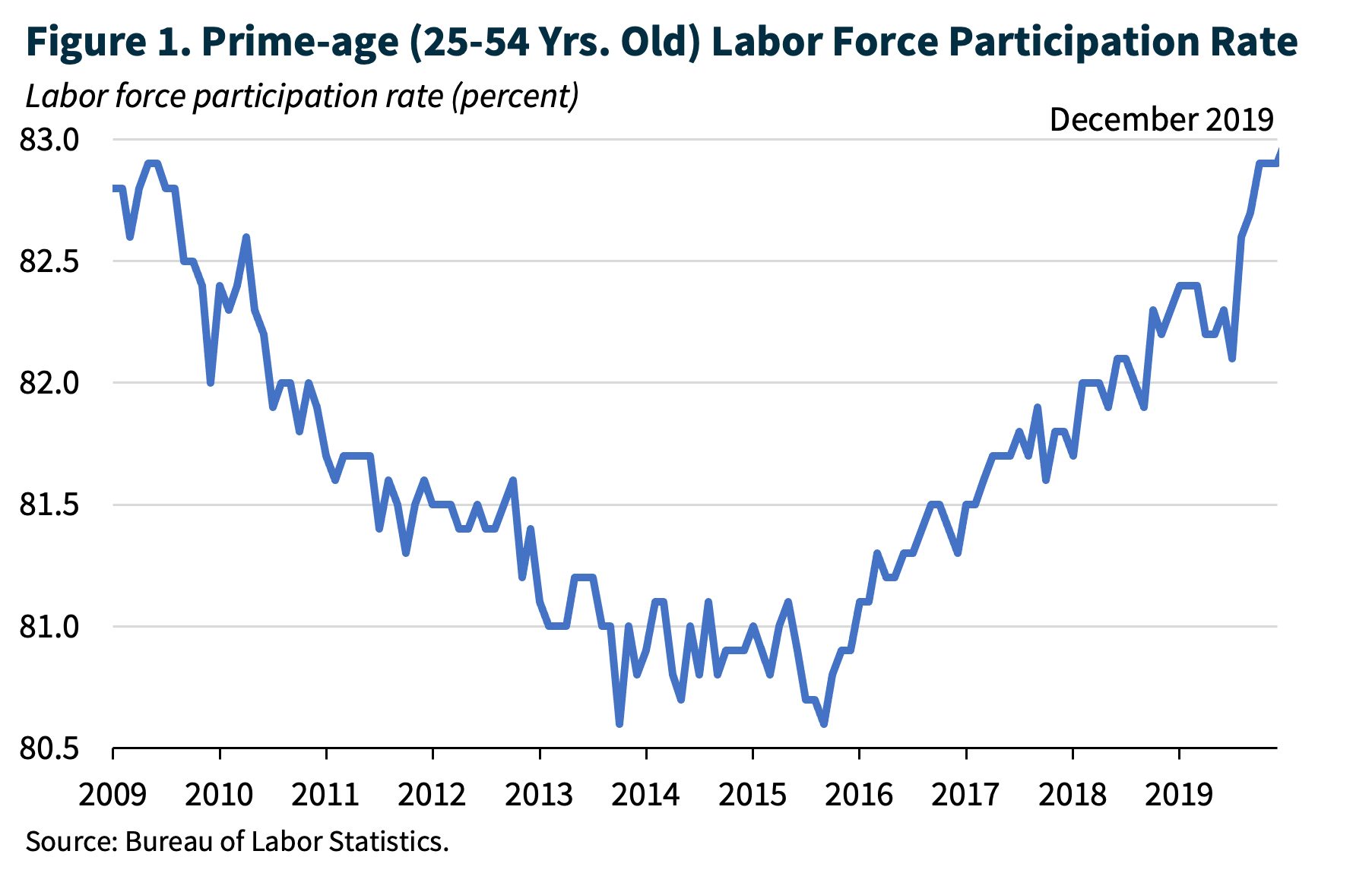

Advocates of supply-side economics have long argued that it should be an economic policy goal of the Nation to increase labor force participation among prime age workers (adults aged 25 to 54). Following the financial crisis, the Obama Administration oversaw ongoing reductions in the portion of prime age adults who participated in the workforce. Following the enactment of reductions in tax rates, greater incentives for companies to invest in the United States, sustained economic growth, and legislation like the First Step Act, the labor force participation rate for adults 25-54 hit the highest level in January 2020 that it had realized since 2008 (BLS, 2021).

Pandemic-related shutdowns and fears that virus mutations continue to pose health risks have caused temporary reductions in labor force participation since the onset of the pandemic, but the danger is that this massive spending package would make this progress reversal permanent. Many progressives advocate for whole segments of able-bodied adults being relieved from any obligation to economically support our Nation.

None of these new or expanded programs contain work requirements as part of eligibility. By raising the permanent, government-provided income of individuals without requiring that they work to realize these benefits, the gains that we were making on the labor force participation rate pre-pandemic will be lost. As the Corinth et al. (2021) paper models, if people’s lives are made too easy with nothing required of them, a portion of the population will choose to not be part of the labor force. This new reality creates daunting prospects for small businesses if the workers they seek to recruit come to believe that they can afford a comfortable lifestyle without contributing to the production of goods and services that fuels America’s economic engine.

Advocates of Universal Basic Income (UBI) argue that automation has eliminated employment opportunities for a significant percentage of the U.S. population. They point to areas like manufacturing where technology-facilitated productivity improvements have greatly reduced the labor portion of the products that are created. However, such automation has not necessarily reduced the overall labor needs of our economy. Some researchers like Acemoglu and Restrepo (2017) find negative effects on employment from investment in robots while others like Koch, Manuylov, and Smolka (2019) find a positive effect.

Certainly, automation has facilitated our transition to a more service-based economy. Efficiency and innovation arising from creative destruction need not be threats to working Americans; they are opportunities to be part of growing sectors of the economy that improve standards of living for our fellow citizens. With our aging population, the quantity of those service jobs our Nation requires will continue to increase. The NFIB survey demonstrates that we are nowhere near the dearth of jobs claimed by UBI’s advocates. Without explicitly labeling it as such, the big government socialism package is progressives’ stealth attempt to create the seeds of UBI.

This permanent socialist expansion would crush small businesses. Without access to workers, small businesses cannot maintain their operating hours, meet the demands of their customers, and realize the innovative growth that drives improvements in the standard of living of everyday Americans. The shortages we have witnessed, the inflation that has led to reductions in real wages, and the slow growth that we witnessed during the Obama years will become the new normal. American workers are essential ingredients to small businesses looking to improve the lifestyles of their fellow Americans. That will not happen if the massive spending package permanently reduces the labor force by millions.

RAISING THE COSTS OF DOING BUSINESS

Small businesses are not just confronting difficulties in identifying and hiring enough workers. They are also being assaulted with increasing costs of doing business due to the return of higher levels of regulation and greater government intrusion into their activities. The latest proposal in the big government socialism bill is a federal takeover of paid family and medical leave that tilts the scales toward big businesses and threatens existing employer paid leave policies. The core of the proposal is a requirement that every employer regardless of size or economic circumstances allow all of their workers—including those who just started on the job—to take 12 weeks off, paid by the federal government, and to leave the position open for when the employee returns, leaving businesses to fend for themselves when pervasive labor shortages are already disrupting supply chains and production timelines. To reiterate, the massive spending bill does not even impose minimum timeframes after getting hired before an employee is eligible. They could literally be hired one day and be eligible for paid leave the next day. While the current Family and Medical Leave Act (FMLA) already has the job retention requirement, the new program would pay workers to take leave and also expand the definition of caregiving to include non-family members. This means that small businesses in particular will constantly be scrambling to find temporary workers for these outages, increasing their costs and decreasing the efficiency of their businesses.

As things stand, the Society for Human Resource Management (SHRM) reports that a majority of employers already offer paid leave policies tailored to the needs of their business and their employees. While the Biden Administration could have built upon the success of the Trump Administration’s efforts to reward companies with tax credits for offering paid leave policies that work for them and their labor force, it has instead taken a different approach. What the massive spending package does is impose a one-size-fits-all plan that places big businesses—which have the resources and wherewithal to more easily handle compliance and employee absences—at a competitive advantage over small businesses. They are the ones that can create the HR processes necessary to support these leaves and have the pool of talent that they can shift around their organization to cover elongated absences. Likewise, larger enterprises are more likely able to facilitate telework or other flexible outcomes, as we observed during the pandemic. Moreover, the bill only compensates employers who offer Cadillac family leave plans that adhere to federal requirements, which threatens existing plans offered by small businesses and could harm their ability to compete for talent against large corporations. The extensive advantages of larger enterprises are enhanced by ever greater regulation and government-imposed requirements like those being contemplated by congressional Democrats and the Biden Administration. The question is whether the economy is enhanced by expanding the advantages of large enterprises relative to smaller ones.

The macroeconomic challenge is that significant innovation arises from smaller ventures. While large enterprises realize economies of scale, they may be resistant to changing their products and practices. Smaller firms are generally more nimble and able to facilitate the entrepreneurial culture that cultivates innovation. According to the SBA, “small businesses make up a substantial majority of firms in patent-intensive industries. Overall, approximately 96 percent of all firms in patent-intensive industries are considered small businesses” (SBA, 2015). Thus, anything we do that further entrenches incumbents and disproportionately raises costs for smaller firms will increase the market power of large businesses, restrain economic growth, and stifle dynamism.

GROWTH EFFECTS FROM HIGHER TAXES

The owners of small businesses pay income taxes at the personal level if they are sole proprietors, partnerships, or S-corporations while those organized as C-corporations have corporate and personal tax burdens. The Democrats’ big government socialism bill raises both. The proposal is to take the top marginal rate from 37 percent to 39.6 percent while lowering the income level at which this rate applies from approximately $520,000 to $400,000 per year. For those making more than $5 million, the bill proposes another 3 percent surtax. It also caps the 20% deduction on pass-through entities that was established in the Tax Cuts and Jobs Act (TCJA) to improve small business competitiveness with larger C-Corps. On top of these federal tax rates, one must add the state level income taxes that reach as high as 13.3 percent in states like California. More than half of every additional dollar in income would be subject to tax in such states. For those small businesses that are organized as C-corporations, the bill proposes to raise the rate from 21 percent to 26 percent with the owners then paying higher tax rates on the portion of those earnings that are distributed to them. Their tax bill raises the tax rate on dividends and capital gains to 25 percent.

Entrepreneurship is an inherently risky activity. Many ventures fail. Nevertheless, we need an economic environment in which risk-taking is encouraged. Until new products are tested in the marketplace, until new technologies are explored, until alternative medical treatments are researched, we do not know whether they will make the lives of everyday Americans better. Such an economic environment requires available workers and limited administrative burdens, but it also means that risk-takers realize the benefits of their efforts.

In a progressive income tax environment, the entrepreneur absorbs most, if not all, of the losses but pays tax rates of up to 50 percent when the venture succeeds. When success is taxed, less is realized. Cross country work by Djankov et al. (2010) finds that a “10 percentage point increase in the first-year effective corporate tax rate reduces the aggregate investment to gross domestic product (GDP) ratio by about 2 percentage points (mean is 21 percent), and the official entry rate by 1.4 percentage points (mean is 8 percent).” Other recent work has looked at variation across U.S. states. Curtis and Decker (2018) find that “for every one percentage point increase in the corporate tax rate, employment in startup firms declines 3.7 percent.” Work by Jaimovich and Rebelo (2017) estimate that an increase in the income tax rate from 30 percent to 60 percent would result in economic growth rates being cut in half. Other work by Akcigit et al. (2018) estimates that a one percent increase in personal income tax rates results in a six percent reduction in patents. Firms invest less, fewer new firms are created, and less employment results.

What does success for a small business look like? It means that they have provided products or services to customers that are valued highly. In most cases, it means employing American workers to assist in the creation of that product or service. It means that they have engaged in activities that have made fellow Americans better off. When the generators of those outcomes have their taxes raised, they will pursue fewer of those outcomes.

A primary objective of the TCJA was to make the U.S. business tax environment more competitive with the rest of the world. Bringing the corporate income tax rate down to 21 percent resulted in a tax rate commensurate with the rate large companies pay in other developed nations. However, most businesses in the United States operate as pass-throughs with the individual income tax being the relevant rate. Therefore, personal income tax rate reductions also encouraged entrepreneurship as successful small business operators were rewarded with keeping more of the value their business creates. Additionally, there was a provision to encourage reinvestment of income back into those small businesses. These activities helped realize the longest economic expansion in the history of the United States, one that was only interrupted by the pandemic.

The Biden Administration and Congress are looking to reverse those rewards to successful innovation. Raising the corporate tax rate to 26 percent lowers economic growth that does not just affect the large multinationals, but also their suppliers, many of whom are small businesses. If those suppliers operate as passthrough entities, the liberal leaders are looking to raise their federal tax rate to 42.6 percent, with state income tax rates added on top of that.

Tax rates directly impact the incentives to grow the private economy. Most of the daily needs of Americans are realized by the production of the private economy. By raising taxes on the businesses of our Nation, we will realize less growth, less innovation, and a lower standard of living.

CONCLUSION

The massive Sanders-Biden big government socialism bill in front of Congress will shrink the private sector and grow the public sector. The results of this legislation will be a smaller labor pool and higher costs of operating in the private economy, further disincentivizing the investment of capital. America does not need fewer small businesses, less productivity, weaker growth, and less overall wealth. Small businesses are the engine of economic growth and they employ roughly half of the American workforce. Their ability to grow and expand are thus inextricably linked to the overall success of America’s families. The outcomes of these proposed policies would be disastrous for our small businesses, and as a result, for all American workers and their families.