Progressives Are the New Regressives

For more than a century, progressives have politically positioned themselves as the protectors of the poor. Whether it was safeguarding consumers from harmful products and workers from unsafe labor conditions or advocating for higher wages for lower-income workers, progressives have proclaimed themselves the advocates of those left behind by society’s advances.

Not so any longer.

The policy agenda of self-declared progressives has become some of the most regressive policy proposals in the public dialogue today. Whether it is student loan forbearance/forgiveness, repeal of the cap on state and local taxes (SALT), inflation resulting from out-of-control fiscal policy, or open borders, these policies all have one thing in common: they disproportionately benefit upper-income individuals at the expense of the poor and middle class. That is even before they take to dismantling the Trump-era tax cuts that produced a blue-collar boom, which resulted in record income gains that were larger for lower-wage workers than for those at the top.

STUDENT LOANS

Following their failure to enact their Big Government Socialism Bill, what they referred to as Build Back Better, the Biden Administration is under growing pressure to use executive action to enact parts they believe can be done by the President alone. Chief among these is student loan forgiveness.

Congresswoman Alexandria Ocasio-Cortez tweeted, “With BBB delayed, Child Tax Credits will expire and student loans will restart within a matter of weeks. Working families could lose thousands of $/mo just as prices are rising. That alone is reason for @POTUS to act on student loans ASAP - w/ either moratorium or cancellation.”

Chasten Buttigieg, husband of Transportation Secretary Pete Buttigieg, responded on Twitter to a notification he received from the Department of Education that his student loan payment was about to restart with “LOL no thank you Merry Christmas next”.

Senator Elizabeth Warren chimed in with, “Student loan debt is holding back a whole generation from buying homes, starting small businesses, and saving for retirement – all things we rely on to grow our economy. Executive action to #CancelStudentDebt would be a huge economic stimulus during and after this crisis.”

Just recently, the Biden Administration caved to this growing pressure and elongated the deferral of student loan payments.

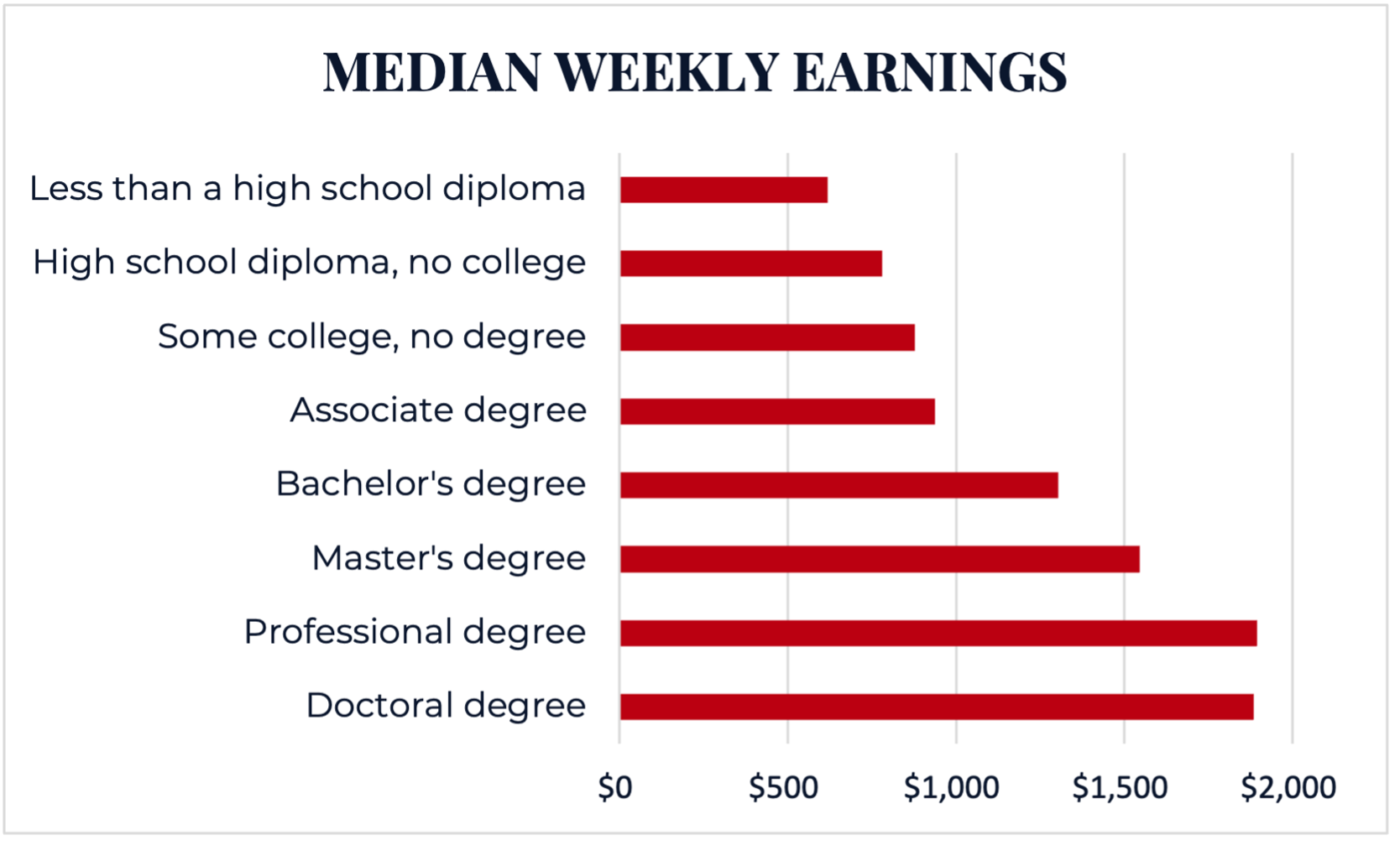

There are few policy proposals under consideration in Congress that are more regressive. The reasons are straightforward. Our economy has shifted toward a more knowledge-based one, and those who completed college, let alone graduate school, earn higher wages. As shown in the Bureau of Labor Statistics graph below, for adults over 25, average income increases with each additional higher level of education attained.

Those who never attend college, including many hardworking Americans, make less money and have no student loan debt. They are therefore not helped by student loan forgiveness. Because of loan amount limitations for undergraduates, they have a moderate amount of student loan debt. Those with the highest amount of student loan debt are those who pursue graduate degrees. They are also the education group that, on average, makes the most money and the least likely to default on their loans. In fact, the student default rate is highest among people with less than $5,000 in loans, many of whom are either college dropouts or attended a low-quality college. Blanket loan forgiveness does nothing to address college quality or dropout risk but delivers a windfall to people who have the highest earnings and greatest capacity to repay their loans. So, the greatest benefit goes to those making higher incomes.

Source: https://www.bls.gov/careeroutlook/2021/data-on-display/education-pays.htm

According to recent research by Constantine Yannelis and Sylvain Catherine, the forgiveness of up to $50,000 in student loan debt would disproportionately help the top half of the income distribution. Specifically, they estimate that households in the lowest ten percent of income would on average receive $705 of benefit under this proposal, whereas those in the 80th to 90th percentile of income would benefit by $6,576. Even if it is just deferral of payments, higher-income borrowers owe more and would benefit more from a delay in payments.

Former Clinton-era Treasury Secretary Larry Summers recently tweeted, “student debt relief is highly regressive as higher income families are more likely to borrow and to borrow more than low income families. Adults with student loans have much higher lifetime incomes than those without.” Despite these analyses, calls for elimination continue because the objective is not to help the poor, but to help their supporters.

SALT CAPS

Another policy pursuit of progressives is the repeal or at least relaxation of the SALT caps. In the Tax Cuts and Jobs Act, Congress limited the amount at $10,000 of state and local income and property taxes that could be deducted from the calculation of income for federal tax purposes. Having more than $10,000 in such expenses is not sufficient to benefit from raising the cap. For married couples filing jointly, they receive a standard deduction of $25,100 in 2021, so they would only benefit from raising the cap if both of the following were true: (1) they have state income and property taxes in excess of $10,000 and (2) they have mortgage interest, charitable deductions, and state income and property tax payments in excess of $25,100. The Americans who find themselves in this situation are not in the lower half of the income distribution.

The SALT modification that was included in the Big Government Socialism Bill raises the cap from $10,000 to $80,000 per year. According to the Committee for a Responsible Federal Budget, households making under $100,000 per year would realize no benefit from raising the cap to $80,000. In contrast, the average household generating $300,000 per year in income would save $5,900 per year in taxes, while households earning $1 million per year would see an average of $25,900 per year benefit from such a change. According to the Tax Policy Center, 94 percent of the benefit from this proposal would go to the top 20 percent of households by income. Further, according to research by Wenli Li and Edison Yu—among others, as discussed in the 2021 Economic Report of the President—repealing the SALT cap would deliver a windfall to wealthy homeowners by accelerating house price gains for expensive properties.

How can self-identified progressives support a benefit that is only realized by those making at least $100,000 per year in household income? Again, their objective is not to support the poor; it is to provide relief to their donors.

INFLATION

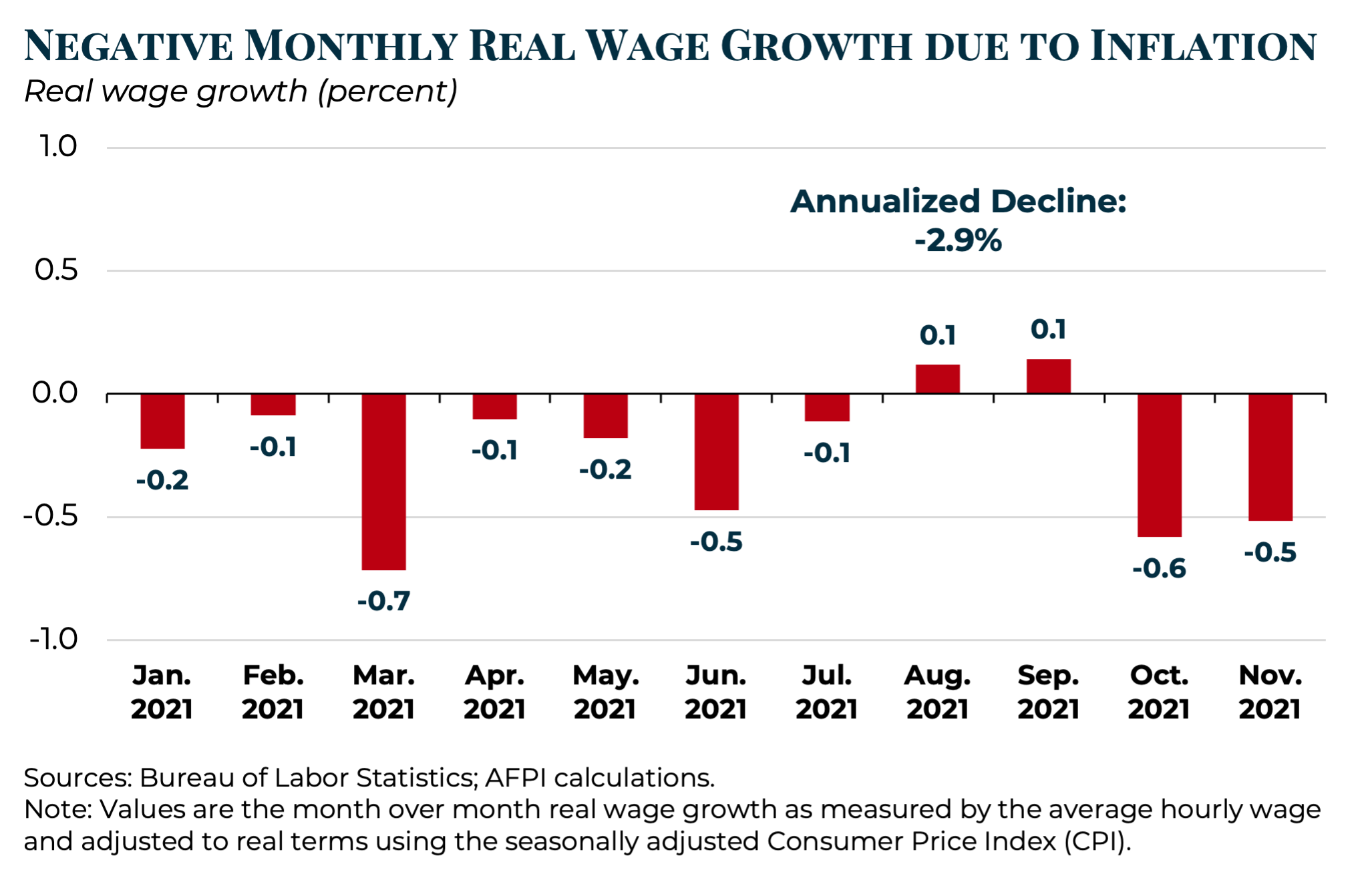

As we have recently documented, the Big Government Socialism Bill being pursued by progressives simultaneously expands demand while contracting supply, thus exacerbating the many-decade-high inflation rates the American people have been suffering from this past year. Paying people not to work and perpetuating government dependency over self-sufficiency causes generational impoverishment while raising prices. Further, the resulting inflation does not affect all Americans uniformly. Price increases are particularly harmful to those who spend a greater proportion of their income (as opposed to saving and investing), especially when wage increases are not keeping up. As seen in the chart below, over the first eleven months of 2021, inflation grew faster than wages in nine of those months. This hurts American workers.

In contrast, the stock market continues to generate strong performance. The result is that the working poor and middle class are falling behind while the wealthy continue to prosper.

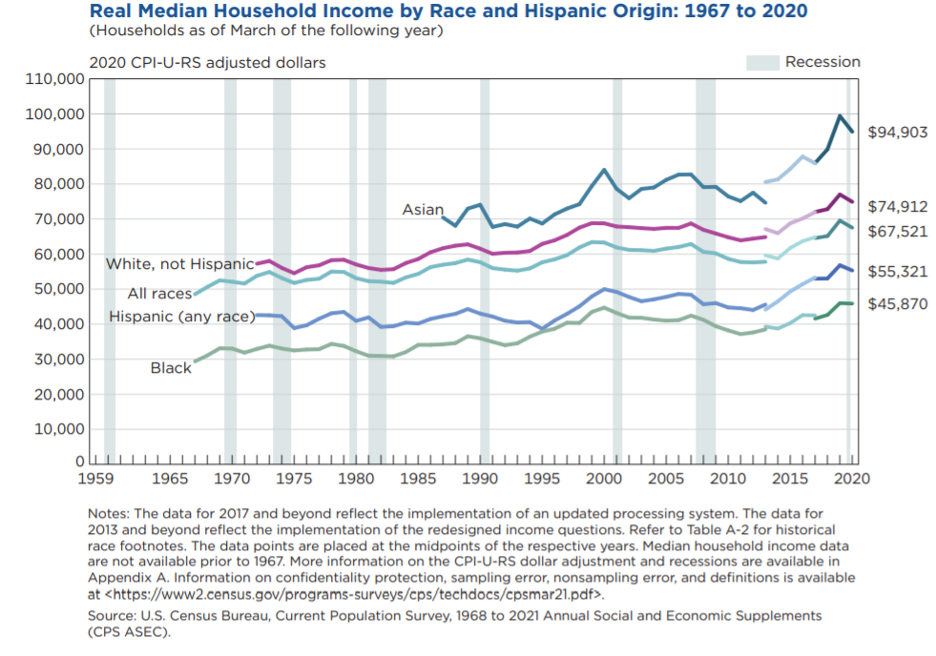

These outcomes are the opposite of what we observed during the Trump Administration, before the onset of the pandemic. According to the Census Bureau, median household income grew 6.8 percent in 2019, the largest increase in the history of the survey. The income growth was particularly high for low-income households and minorities. As the figure for household income below shows, following the enactment of the Tax Cuts and Jobs Act in 2017, all races realized a significant uptick. In addition, the poverty rate hit the lowest rate since the survey began in 1959. Pro-growth policies that encourage employment cause greater improvements in inflation-adjusted outcomes than socialism.

IMMIGRATION

IMMIGRATION

Progressives have also been vocal advocates for expanding immigration, including amnesty for potentially tens of millions already illegally present in the United States. As Representative Alexandria Ocasio-Cortez recently tweeted, “Immigration should not be a crime, and its criminalization is a relatively recent invention” (which is false in that “entry without inspection” has been a federal crime for decades). Her colleague Ilhan Omar has called for Immigration and Customs Enforcement to be abolished and to “[f]ight back against the criminalization of immigration and crossing the border.”

Again, this policy has a differential impact on the American people. As argued by George Borjas, both illegal and legal immigration have both costs and benefits. Both open borders and cheap visa-based foreign labor decrease wages for those with the least amount of education as both illegal aliens and cheaper legal foreign labor compete with Americans for low-skilled positions. As Mr. Borjas states, “the laws of supply and demand do not evaporate when we talk about the price of labor rather than the price of gas.”

While wealthier Americans benefit from a reduction in the costs of goods and services they receive from low-skill workers, many of those workers themselves are made worse off from the free flow of low-wage workers entering our country illegally and legally. Once again, progressives are pushing policies that benefit higher-income individuals to the detriment of lower-income Americans.

CONCLUSION

Progressives have abandoned the hardworking Americans who made this country great. Their agenda is instead centered on the college-educated woke who gentrify urban centers. Their agenda is to promote the elitist indoctrination of our youth, subsidize their blue state big government spending agenda, depress the wages of the service providers who clean their condos, and pad the retirement accounts of their upper-income contributors. It is time to call this new crop of liberals what they really are— Regressives.