America First Policy Institute

Opportunity Zones 2.0: The Next Chapter of Rebuilding America’s Forgotten Communities

Key Takeaways

The 2017 Tax Cuts and Jobs Act launched the Opportunity Zones (OZ) tax incentives, which have boosted private investment, job growth, and affordability in nearly 8,800 distressed census tracts across America.

Unfortunately, OZs are set to expire soon. Policymakers should renew and enhance OZ incentives to increase their reach and impact, making them an enduring policy pillar aimed at rebuilding America’s forgotten communities.

A robust OZ 2.0 package should prioritize permanence, simplified compliance, greater transparency, broader investor participation, rural expansion, and extra-strength incentives for high-impact investments that address critical problems like the inflation-induced affordability crisis.

OZs 2.0 should incentivize responsible state and local deregulation to remove artificial barriers to prosperity and better steward federal taxpayer dollars.

Introduction

The 2017 Tax Cuts and Jobs Act made many significant prosperity-enhancing reforms to the tax code, but arguably, no provision is proving more game-changing and consequential for America’s struggling and forgotten communities than the pioneering Opportunity Zones (OZ) policy. Instead of adopting the worn-out and failure-prone government-centric approach to stimulating economic development and community revitalization, the OZ policy put in place tax incentives to unlock capital and allow the private sector to direct it to the nearly 8,800 economically distressed census tracts designated as OZs. In just its first few years after going fully into effect, the OZ incentives have brought $84 billion in job-boosting and affordability-enhancing investment to communities seeking to climb the ladder (JCT, 2024). From starting film studios to building manufacturing facilities to expanding the supply of housing to constructing new schools of choice, OZ investments have brought much-needed quality jobs, capital, and amenities to left-behind communities, improving the economic environment for current and future residents. Demonstrating their impact, OZs now account for 20 percent of all new market-rate apartment unit development nationwide (EIG, 2024), and the incentives have caused employment growth in OZ-designated communities to outpace growth in comparable non-OZ communities by 3 to 4.5 percentage points (Arefeva et al., 2024).

The main pillars of this first-generation OZ policy (OZs 1.0) are the following:

- Investors who realize capital gains from a prior investment and roll over the gains into a Qualified Opportunity Fund (QOF) that invests in qualified OZ businesses receive a tax deferral on their original gains until they exit the OZ investment or December 31, 2026, whichever is earlier. This incentive encourages Americans to reinvest their gains in OZs instead of cashing them out.

- Investors who keep their funds invested in the OZ for five years receive a 10 percent step-up in basis (which reduces taxable income) on their original gains. The step-up increases to 15 percent if they keep their money invested for seven years. This incentive ensures that OZ investments are long-term in nature, allowing their transformational impacts to grow with time.

- Investors who keep their funds invested in the OZ for 10 years pay zero capital gains tax on all new gains accrued from the OZ investment itself. This incentive builds on the basis of step-up and rewards people for putting their capital on the line in the most distressed areas by allowing them to keep the full fruits of those investments.

With just two years until the program expires, unfortunately, the clock is running out. Lawmakers can avert such an untimely end and build upon this legacy by renewing a stronger and streamlined OZs 2.0. The broad goals of OZs 2.0 should be to (i) attract even more robust private investment into low-income communities, (ii) expand the OZ map to more communities in need, especially in rural areas, (iii) address the affordability crisis and other critical problems in dire need of supply-boosting investment, and (iv) incentivize the removal of artificial regulatory barriers that limit economic potential, impede the rebuilding of America, and inflate costs to federal taxpayers. The rest of this brief describes OZ 2.0 ideas to advance these goals and usher in a renaissance in America’s down-but-not-out communities. These ideas can be pursued individually or in concert with each other for enhanced effect.

Reforms to Increase OZ Investment and Participation

The first generation of OZs is already a pioneering policy that removes the layers of bureaucracy that are the hallmark of many economic development policies. OZs 2.0 can take matters a step further by delivering greater predictability, improving user-friendliness and flexibility, and extending OZ eligibility criteria to broaden investor participation and potential investment opportunities.

Ensure Predictability

Communities stand to benefit from greater investment if investors can operate in a more predictable environment that is conducive to long-term planning. Thus, extending OZs further into the future is not just a way to perpetuate their success; it is also a way to make them more immediately successful.

Recommendations

- Make OZs a permanent fixture of the tax policy landscape, with redesignation of OZ census tracts and potential tweaks to policy parameters occurring every 10 years to reflect updated economic conditions across America and ensure maximum OZ impact.

- Implement robust but low-hassle reporting and transparency provisions—such as those proposed in the Opportunity Zones Transparency, Extension, and Improvement Act (OZTEIA, 2022)—to facilitate the process of redesignating OZs and refining policy parameters.

- Establish an investor’s eligibility for different incentive tiers (e.g., basis step-up) based on the date of initial investment. If a tract loses its OZ designation, investors whose money is already deployed in the tract before the loss of designation will continue to receive the OZ incentives. This reform would lower the risk of investing in OZs, thereby attracting larger flows of capital.

- Allow investors to lock in the capital gains tax rate that was in place on the initial investment date. This reform would help protect communities from the damage of possible future capital gains tax hikes. Otherwise, investors would pull their money out to pay the tax before the hike takes effect.

If a permanent extension of OZ incentives proves infeasible, an alternative would be to create a 10-year rolling renewal of the incentives. In this scenario, the renewal decision should occur five years before the termination date to enable planning and avoid disruptive OZ cliffs. Either renewal could be automatic, subject to congressional override, or the default could be for OZs to sunset unless Congress actively voted to extend the policy. If even this 10-year rolling renewal was infeasible, then at the very least, the deadline for OZ 1.0 investments should be extended to compensate for the original two-year rulemaking delays that kept some investors on the sidelines. The OZTEIA includes such an extension.

Improve User-Friendliness and Flexibility

Relative to other economic development policies, the OZ incentives already represent a substantial reduction in bureaucracy. Nevertheless, based on lessons learned from OZs 1.0, the next-generation OZ 2.0 policy should further simplify compliance and boost ease of use to remove any unnecessary obstacles to participation by investors seeking to deploy capital and by the OZ businesses that receive such investment.

Recommendations

- Allocate federal funds for states and localities to boost technical assistance and local capacity building, such as the proposed State and Community Dynamism Fund in the OZTEIA.

- Streamline OZ rules to simplify compliance and further reduce compliance costs by creating stakeholder-specific, step-by-step guides on how to navigate OZs. Examples include guides for:

- Communities seeking to attract investment to catalyze economic development.

- OZ businesses seeking to raise capital to grow their operations.

- Investors seeking to deploy capital to create impact and generate greater opportunity.

- Allow a “fund-of-funds” model to enable investment managers to more easily pool capital and invest the money in someone else’s fund that has already identified promising OZ businesses. Allowing intermediary investments into “feeder funds” facilitates investments into smaller QOFs.

- Create an “OZ exchange” mechanism that allows investors to exit one OZ investment and swap it for another without impairing their OZ tax incentives. This way, capital remains invested in the communities where it is most needed but is not needlessly locked up in specific projects.

- Increase the flexibility of QOFs to redeploy capital without compromising investors’ timeline for tax incentive eligibility (e.g., the five-year and seven-year requirements to earn basis step-ups).

- Modernize complex, rigid, and internally conflicting OZ regulations that needlessly interfere with sound investment practices.

- For example, disguised sale rules interfere with many non–real estate businesses’ ability to make investor distributions after a refinance, but not distributing money after a refinance could violate non-qualified financial property limits.

- As another example, the 5 percent Non-Qualified Financial Property limits for cash or cash instruments often prove challenging or unworkable for non–real estate businesses.

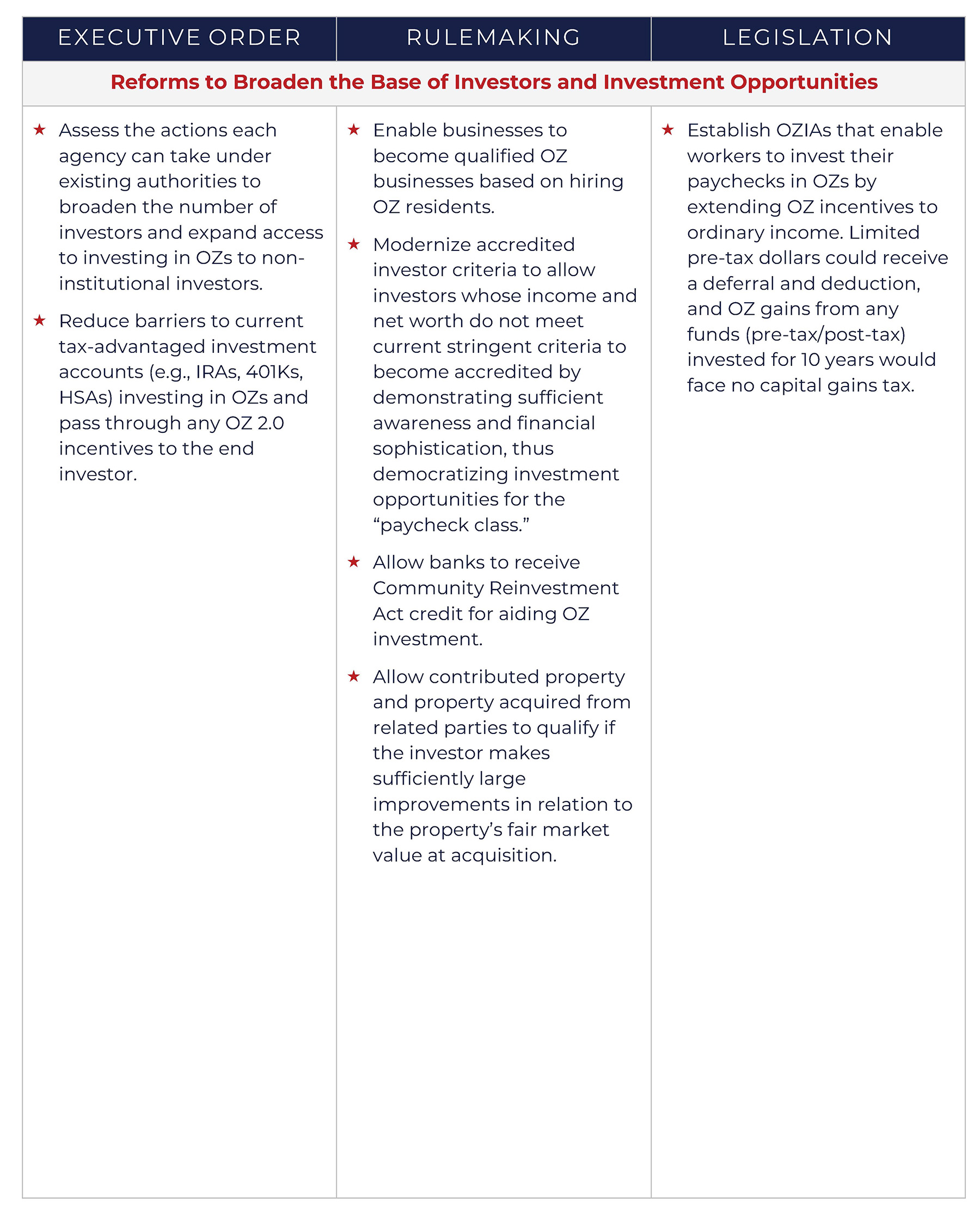

Broaden the Base of Investors and Investment Opportunities

Incentives like the basis step-up are currently reserved in OZs 1.0 for capital gains income from previous investments rolled over into a QOF. Extending tax incentives in OZs 2.0 to other income would dramatically expand the investor base to include Americans without large investment portfolios. OZs 2.0 could further expand the investor base by counting OZ investments toward a bank’s other regulatory compliance obligations. On the investment side, OZs 2.0 should expand the qualification criteria to become a Qualified Opportunity Zone Business (QOZB) and should reassess current stringent criteria for which types of property can qualify.

Recommendations

- Establish OZ Investment Accounts (OZIAs) that enable workers to invest their paychecks in OZs by extending OZ incentives to ordinary income. Limited pre-tax dollars could receive a deferral and deduction, and OZ gains from any funds (pre-tax/post-tax) invested for 10 years would face no capital gains tax. This reform would deepen the pool of capital available to OZ communities and businesses and allow people from all walks of life to contribute to the rebuilding of America.

- Toward the same end, reduce barriers to current tax-advantaged investment accounts (e.g., IRAs, 401Ks, HSAs) investing in OZs and pass through any OZ 2.0 incentives to the end investor.

- To further democratize investment opportunities for the “paycheck class,” modernize accredited investor criteria to allow investors whose income and net worth do not meet current stringent criteria to become accredited by demonstrating sufficient awareness and financial sophistication.

- Create an alternative QOZB criteria tied to hiring OZ residents. This way, a business could choose whether to become a QOZB by engaging in most of its activity in an OZ and holding most of its property in an OZ or by hiring a significant fraction of its workforce from people living in OZs. Communities benefit both from the broader range of businesses that gain access to OZ funds and from the incentive for businesses to expand their local hiring.

- Give banks Community Reinvestment Act credit for activities that facilitate OZ investment.

- Allow contributed property and property acquired from related parties to qualify if the investor makes sufficiently large improvements in relation to the property’s fair market acquisition value.

Reforms to Extend the Reach and Magnify the Impact of OZs

The OZ incentives are valuable for what they bring to distressed communities—jobs, capital, and amenities—and for what they help keep away: inflationary pressures. For example, recent research finds that OZs are alleviating rent pressure through more market-rate residential development (EIG, 2023). OZ 2.0 reforms could build on this success by extending the OZ incentives into more communities and enhancing them to reward high-impact investments that address critical needs like the housing affordability crisis.

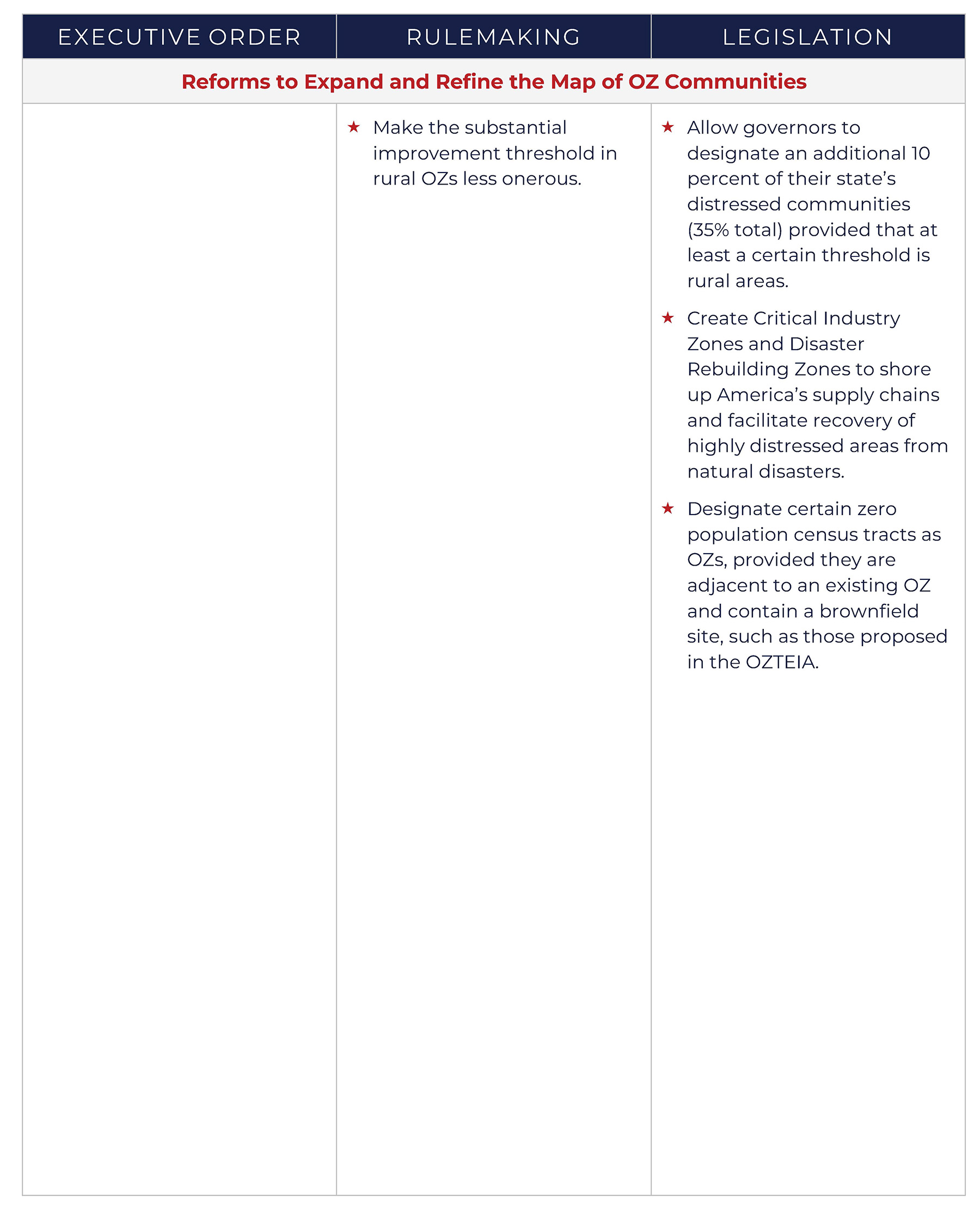

Expand and Refine the Map of Designated OZ Communities

OZs 1.0 allowed the governor of each state or territory to designate 25 percent of the economically distressed communities (census tracts) as OZs (or 25 tracts if there were fewer than 100 low-income communities from which to choose). Even though there are currently almost 8,800 OZs, many additional struggling communities remain in need of the economic revitalization that comes from private investment. By virtue of being farther from other services and unable to tap into economies of scale, many of America’s rural areas suffer particular hardship and face unique challenges. In addition, communities that may not qualify as high poverty may still be cost-burdened because of exorbitant housing expenses as a share of income. OZs 2.0 could make progress on both fronts by increasing the number of OZ-designated tracts and expanding eligibility.

Recommendations

- Allow governors to designate an additional 10 percent of their state’s distressed communities (for a total of 35 percent), provided that at least a certain threshold is rural areas. OZs 2.0 could also overhaul the low-income definition that is used to determine OZ eligibility by following the Rural Opportunity Zone and Investment Act as a possible model.

- Reduce the substantial improvement threshold (e.g., from 100 percent to 50 percent) in rural OZs to expand the effective OZ map by making investment eligibility less restrictive and onerous.

- Allow governors to designate high-distress census tracts contained within a federally declared disaster area as OZs called Disaster Rebuilding Zones.

- Create Critical Industry Zones that designate a new business as a QOZB if it is primarily engaged in creating products or services in a critical industry as defined by the Commerce Department.

- Designate certain zero population census tracts as OZs, provided they are adjacent to an existing OZ and contain a brownfield site, such as those proposed in the OZTEIA.

- Regardless of the criteria above, redesignation should occur every 10 years with the latest data. For example, the OZTEIA would remove the OZ designation for tracts with a median family income greater than or equal to 130 percent of the national median family income.

Strengthen Incentives and Reward Deregulation for Investments that Boost Housing Affordability

The baseline OZ tax incentives currently in place and extended by OZs 2.0 already make it compelling to invest in OZs, but addressing critical problems such as the ongoing housing affordability crisis calls for an even more robust approach. Allowing investors to receive stronger incentives for high-impact investments would focus on the private sector's ingenuity and innovative potential to deliver much-needed solutions.

Recommendations

- Create a higher tier of OZ+ incentives (e.g., a more generous basis step-up and relaxed minimum investment timelines) for housing investments that satisfy certain affordability requirements.

- Reward states and localities that ease regulatory barriers to the construction of new housing by adding an OZ Impact Badge (OZIB) designation to OZs in their jurisdiction. OZIB designation can either be an added requirement for the upgraded OZ+ incentives or else can unlock an even stronger OZ++ tier. Objective criteria, not bureaucratic whim, must decide OZIB designation.

- If OZIB designation is an added requirement, then only affordable housing investments in OZIB communities (a subset of OZ communities) would receive OZ+ incentives; all other OZ investments would receive the standard OZ incentives.

- If OZIB designation unlocks a stronger OZ++ tier, then the following hierarchy would apply: affordable housing investments in OZIB communities would receive OZ++ incentives, affordable housing investments in OZs without OZIB designations would receive OZ+ incentives; other OZ investments would receive the baseline OZ incentive.

- The objective criteria determining OZIB designation could either be a front-end point system that rewards specific deregulatory actions (e.g., addressing anti-growth land-use restrictions, inflated building codes, rent controls, etc.) or a back-end measurement of housing supply outcomes (e.g., progress increasing the growth rate of permits and starts).

- To further address the housing affordability crisis, expand OZ incentives for affordable housing investments to non-OZ census tracts that are non-affluent (below median income), cost-burdened (median rents exceed 30 percent of median income), and qualify for OZIB designation.

OZs 2.0 could also lower the 100 percent substantial improvement requirement on affordable housing projects, for example, by adopting the substantial improvement requirement used by the Low-Income Housing Tax Credit program (the greater of $6,800 per unit or 20 percent of the adjusted cost basis of the property). Looking beyond housing, OZs 2.0 could, in principle, create additional OZIBs for other impact investments that solve critical needs like healthcare access, crime, food deserts, and a lack of school choice.

Conclusion

OZs already have a proven and increasingly compelling record of attracting investment and jobs to struggling areas. Letting them expire would mark a tragic end to a great American turnaround story. Instead, now is the time for lawmakers to enact a new and improved OZs 2.0 package to usher in the next chapter in the renaissance of America’s forgotten communities.

Resources