TCJA Expiration Would Increase Tax Burden on American Families

Context

The Tax Cuts and Jobs Act (TCJA) of 2017 included numerous provisions that significantly reduced the tax burden of the previous tax code on American families. Some provisions are scheduled to expire after 2025 unless a new law is enacted to make those temporary provisions permanent. American families are poised to face a significant tax hike in 2026 once TCJA provisions expire.

Major Changes TCJA Expiration Will Trigger

- Lower take-home pay through increased marginal rates and a smaller standard deduction.

- Less support for parents raising children through a smaller child tax credit.

- Reduced investment through higher tax rates and less generous deductions for small businesses.

- Subsidization of high-tax state and local governments through an uncapped SALT deduction.

Single filer with a property making $160K |

Single filer without a property making $110K |

Family of two without a property making $60K |

Family of four without a property making $220K |

$1,800 more in tax liabilities |

$2,950 more in tax liabilities |

$700 more in tax liabilities |

$7,240 more in tax liabilities |

Summary

The simplest way to understand the significance of the scheduled expiration of temporary TCJA provisions in 2026 is to compare American families’ tax liabilities between the scenario where those provisions expire and where they are extended. This analysis uses an open-source modeling tool to estimate the immediate economic effect of the potential expiration on a number of American families.

Overview

TCJA has significantly lowered the tax burden on American families and businesses. However, most TCJA provisions affecting individuals are scheduled to expire at the end of 2025, and some provisions affecting businesses are scheduled to expire between 2025 and 2028. If no new law is enacted to change that, these provisions will revert to their pre-TCJA values but calculated with the new inflation adjustments under TCJA.[1]

This analysis focuses on the following changes for individuals and families that will be triggered by TCJA expiration:[2]

- Higher marginal tax rates. Marginal rates will revert to the generally higher pre-TCJA levels (from 10% to 10%, 12% to 15%, 22% to 25%, 24% to 28%, 32% to 33%, 35% to 35%, and 37% to 39.6%). The higher rates will also kick in at lower income thresholds.

- Lower standard deduction amounts. Because TCJA nearly doubled the standard deduction amounts in 2017, those amounts (adjusted by inflations) would now be nearly halved (from $15,440 to $8,310 for single filers and from $30,880 to $16,620 for joint filers) upon TCJA expiration.

- Lower child tax credit limit. The maximum credit per child will be halved from $2,000 to $1,000. The credit will also start to phase out at a lower income threshold.

- Open-ended state and local tax deductions. Should a filer choose to itemize, the TCJA-era cap of $10,000 on state and local tax (“SALT”) deduction will not apply after expiration.

We present a series of scenarios to explore the impact on American families if TCJA’s temporary provisions expire (“TCJA expiration”), compared to if they are extended (“TCJA extension”). We investigate this impact using an open-source model of tax liabilities known as Tax-Cruncher, which is developed by the PSL Foundation[3] and hosted at OFRA Labs.

Estimating the Personal Impact of TCJA Expiration

The following case studies investigate the tax liabilities several hypothetical families would face in 2026, depending on whether TCJA has been extended or expired by then. This analysis only focuses on the liability effect of the reform, not the macroeconomic headwinds families would face from a more sluggish U.S. economy.

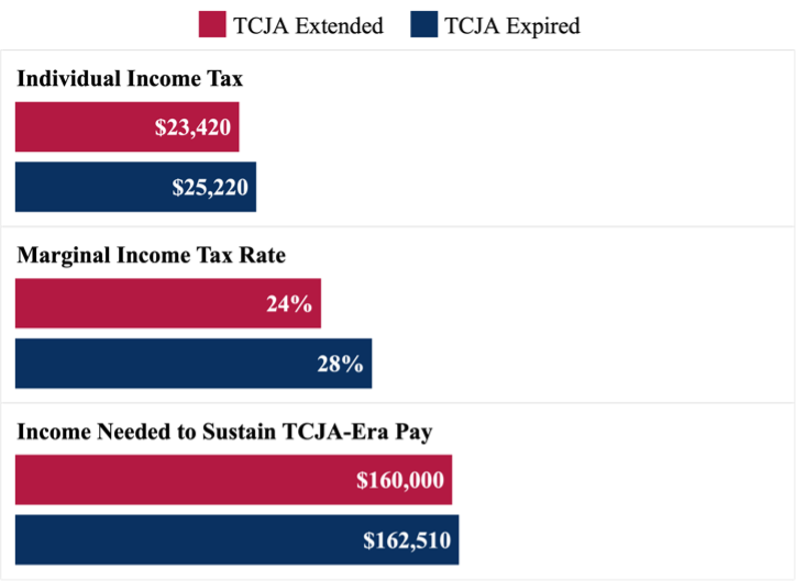

Taxpayer 1: This filer, 40 years old, lives in Hawaii and is single with no children. He makes $160,000 a year and recently bought a home when the interest rate was high. In 2026, this taxpayer paid $1,300 in real estate taxes, $8,000 in state and local income taxes, and $22,500 in mortgage interest. Upon TCJA expiration, he will pay $1,800 more in taxes, face a four percentage points higher marginal rate, and need to make an additional $2,510 a year, at least, to sustain his TCJA-era take-home pay.

This filer will find it advantageous to claim itemized deductions (with a total of $31,800) regardless of the standard deduction reversal. The tax increase for this taxpayer, therefore, is solely driven by the higher individual tax brackets triggered by TCJA expiration.

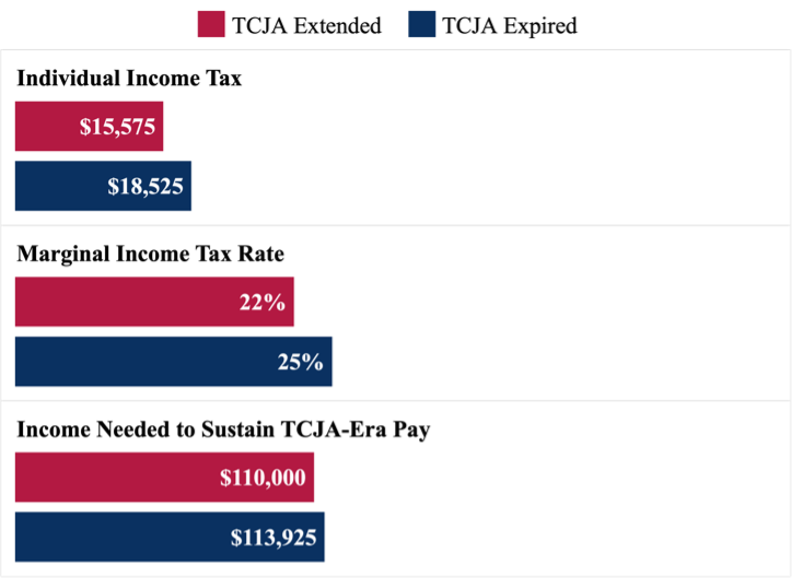

Taxpayer 2: This New York single filer, 30 years old, has no children. She has an annual salary of $110,000. She doesn’t own any property, but in 2026, she paid $6,400 in state and local income taxes. Upon TCJA expiration, she will pay $2,950 more in income tax, face a three percentage points higher marginal rate, and need to make at least an additional $3,925 a year to sustain her TCJA-era take-home pay.

The increase in this filer’s tax liability is driven by two factors. First, similar to Taxpayer 1, the expiring marginal rate brackets mean more taxes. In addition, because this taxpayer will find it advantageous to claim the standard deduction, the decrease in the deduction amount from approximately $15,440 to $8,310 upon TCJA expiration makes up the majority of the tax hike on Taxpayer 2.

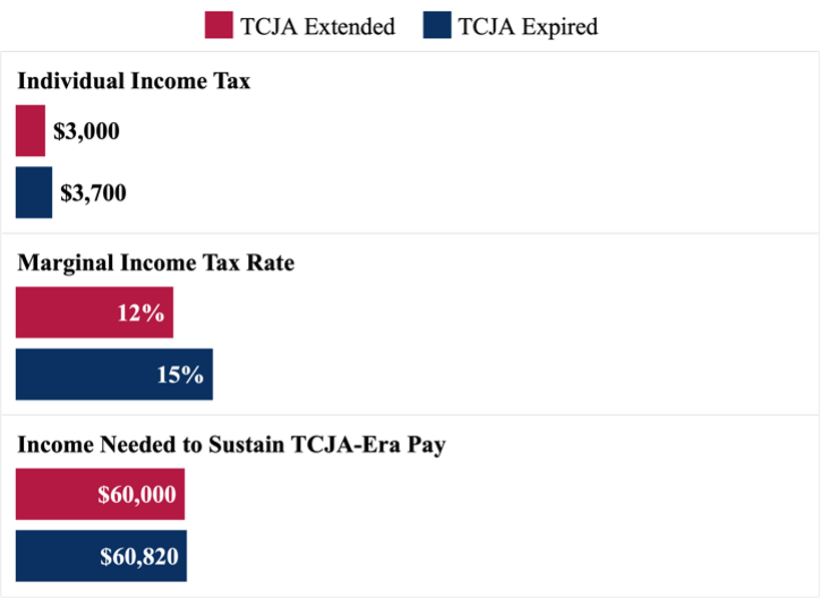

Taxpayer 3: This New York joint filer in their 30s has no children. The couple has a combined annual salary of $60,000 and owns no property. In 2026, they have paid $3,500 in state and local income taxes. Upon TCJA expiration, they will pay $700 more in income tax, face a three percentage points higher marginal rate, and need to make at least an additional $820 a year to sustain their TCJA-era take-home pay.

Similar to Taxpayer 2, the two factors driving the tax liability for this filer are the higher marginal rates and the lower deduction amount. However, since the couple has a lower income and is filing jointly, the impact of the different tax rates is much less significant than the halving of the deduction amount from $30,880 to $16,620.

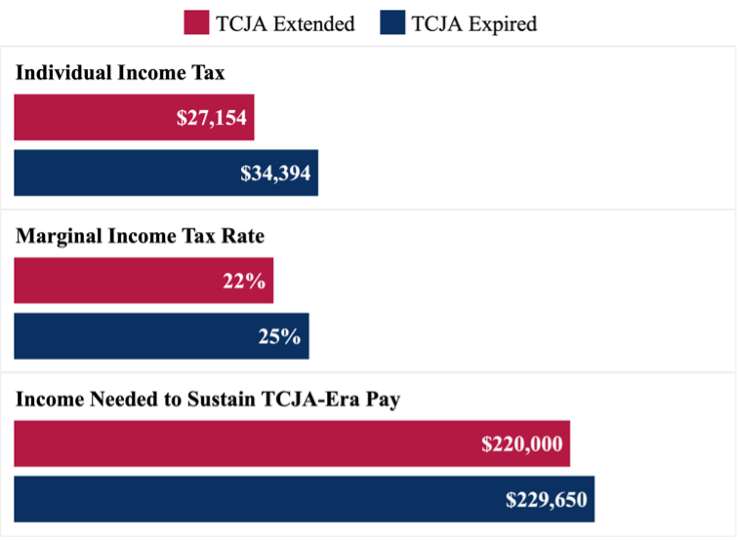

Taxpayer 4: This married couple with two young children lives in Pennsylvania without owning a property. They have a combined annual salary of $220,000. In 2026, they pay $6,800 in state and local income taxes. Upon TCJA expiration, this family will pay $7,240 more in income tax, face a three percentage points higher marginal rate, and need to make at least an additional $9,650 a year to sustain its TCJA-era take-home pay.

The tax increase on this filer is significantly higher than that on the previous three taxpayers because of three changes caused by TCJA expiration: (1) the same tax bracket increase, (2) the same decrease in the standard deduction amount, which this family will prefer over itemized deduction regardless of TCJA, and additionally, (3) the decrease in the child tax credit from $2,000 to $1,000 per child. Because of these factors, this family will need to make 4.4% more in combined salary to maintain its after-tax income from before TCJA expiration.

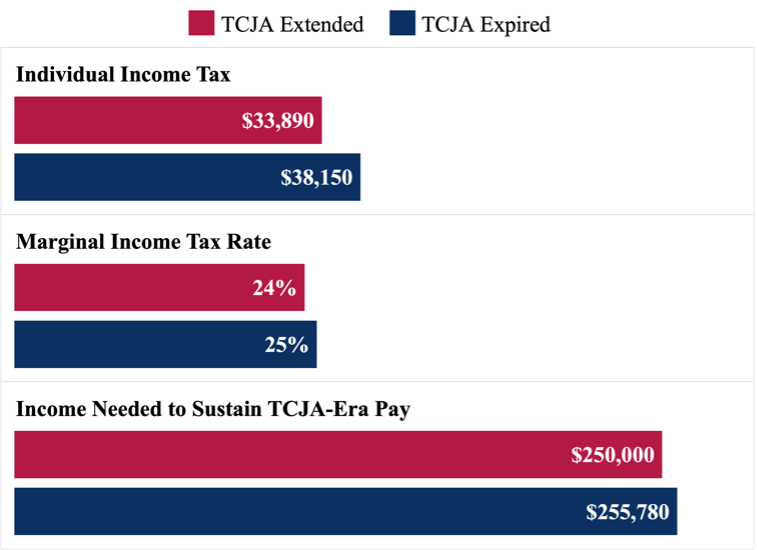

Taxpayer 5: This is another married couple with two young children in Pennsylvania, living in a property they own. They make $250,000 a year in salary, and in 2026, they pay not only $7,700 in state and local income taxes but also $5,700 in property tax and $18,200 in mortgage interest. Upon TCJA expiration, this family will pay $4,260 more in income tax, face a one percentage point higher marginal rate, and need to make at least an additional $5,780 a year to sustain its TCJA-era take-home pay.

The filer has a similar income as Taxpayer 4, but because of the property they own, the family will prefer itemizing regardless of TCJA expiration. However, because TCJA places a $10,000 limit on deductible state, local, and property taxes, this family can claim $28,200 of itemized deduction before TCJA expiration but $31,600 of it after that. Therefore, although this family will still face a significant tax hike due to the higher tax brackets and lower child tax credit, the impact is moderated by the removal of the SALT cap.

Conclusion

American families have broadly enjoyed the fruits of TCJA since it took effect in 2018. This analysis has shown that if its temporary provisions are set to expire after 2025, many individuals and families will face a significantly heavier tax burden for as long as no new law is enacted to change or alleviate that.

[1] Many elements of the tax code, such as deduction amounts and income thresholds for tax brackets, are adjusted annually to account for inflation. The inflation index used for the adjustment before TCJA tends to overestimate increases in the cost of living. TCJA permanently substituted the index with a more accurate (but lower) measure.

[2] For details about the expiring TCJA provisions, see: U.S. Congressional Research Service. Reference Table: Expiring Provisions in the “Tax Cuts and Jobs Act” (TCJA, P.L. 115-97) (R47846; November 21, 2023), by Margot L. Crandall-Hollick, Donald J. Marples, and Brendan McDermott.

[3] GitHub, “Tax-Cruncher” (release 0.6.0), https://github.com/PSLmodels/Tax-Cruncher.