The Importance of U.S. Refining Capacity

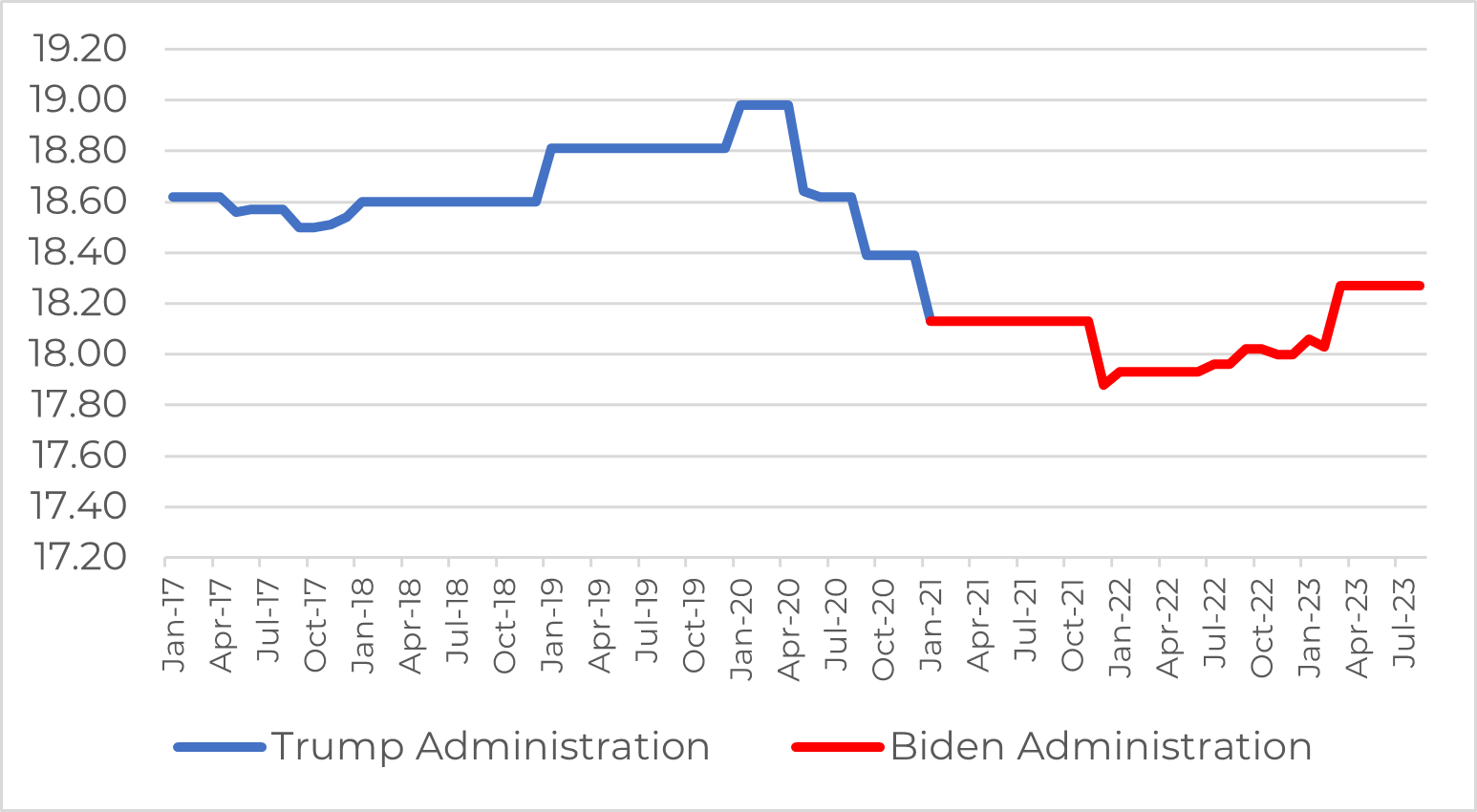

Oil refining is a crucial step in the energy supply chain that influences the eventual price consumers pay at the pump. The U.S. refines nearly one-fifth of global crude oil, accounting for 18.1 million barrels per day (bdp). However, during the last three years, the U.S. refining capacity has decreased markedly, straining domestic and international supplies of refined oil while raising energy prices worldwide. If these trends continue, our Nation’s refining industry will face significant challenges in the next few years that will affect millions of Americans.

Demand for liquid fuels is set to increase significantly.

According to the U.S. Energy Information Administration, global demand for liquid fuels is set to increase by nearly 20 million bpd by 2050, from 101 million to more than 120 million bpd.

Refining capacity is critical to American energy and national security.

Despite continued demand for liquid fuels, a government-led energy transition in the U.S. and Europe risks eroding local refining. Meanwhile, Asia, the Middle East, and South America are projected to increase their refining capacity.

- The development of hydraulic fracturing, and the associated boom in affordable feedstock, increased American refining production over the last decade.

- With the help of a pro-development regulatory environment, the Trump Administration oversaw both an increase in refining capacity before the pandemic and the increasing use of American crude oil in domestic refining.

- Refinery production increased to 18.97 million bpd, which enabled the U.S. to become a net total energy exporter.

- In 2019, gas prices averaged $2.25/gallon, compared to the monthly average price of $3.74/gallon in October 2023.

- Without adequate refining capacity, the U.S. is at risk of a fuel supply crisis.

- The diesel shortage of 2022, which saw near-record low inventories for and record-high prices for diesel fuels, underscores the critical role that refinery production plays in maintaining economic stability.

The U.S. refinery capacity has declined significantly in the last three years:

- Since 2020, refinery production capacity has fallen from a peak of 18.98 million bpd to 18.27 million bpd as of August 2023.

- In the last three years alone, the U.S. has lost six operable petroleum refineries.

U.S. Operable Crude Oil Distillation Capacity (Million Barrels per Calendar Day)

- The central issues affecting the closure of refineries are twofold:

- During the pandemic, closures were partially a response to low demand for liquid fuels. Even though demand has rebounded, the current economic and regulatory environment has made it nearly impossible for them to re-open.

- In the long term, maintenance costs and upgrades required for refineries to remain in operation are a central issue. Yet, the Biden Administration’s stated aim to eliminate fossil fuels from our energy mix — backed up by threats of tax hikes and greater regulatory bureaucracy — fuels investors’ concerns about the profitability of the refining industry.

- LyondellBasell is a prime example of the Biden Administration’s policy effect on the refining market. Lyondell announced the sale of its Houston refinery in September 2021. Yet, due to the cost of maintenance overhauls, Lyondell is unable to sell the refinery.

- Falling regional demand for fossil fuels in Europe is also a risk to U.S. refineries.

- Industry analysts project that between 5–41% of refining capacity in North America could face negative profitability margins by 2040.

- The Biden Administration’s reversal of efforts to streamline regulatory policies, such as the National Environmental Policy Act, place undue strain on small-scale refineries that threaten their financial viability.

Solution:

The federal government can empower the revival of American refining capacity by removing policies that unfairly target the fossil fuel industry. This includes:

- Putting an end to the weaponization of capital. Doing so would facilitate investment in American refining capacity.

- Pursuing comprehensive permitting reform. Slashing red tape would enable the construction and renovation of refining infrastructure.