Issue Brief: Biden Administration Inflation & Oil Markets

Our present oil market woes have their roots in pandemic-induced demand reduction, quicker than anticipated demand recovery, and underinvestment stemming from anti-fossil climate policies. Russia’s invasion of Ukraine and the West’s response are serving as contributing factors—not the origin. Developing a strategy to alleviate market pressures will require the Biden Administration to resist interventionist tendencies and promote an unhindered energy market.

Biden’s Price Deflection & Oil Market Mismanagement

“You may have noticed…gas prices have gone up; a lot of it has to do with Vladimir Putin.” The statement by White House Press Secretary Jen Psaki, TikTok influencers, and media pundits that echoed her “Putin’s price hike” messaging, ignores market dynamics and the policy decisions of the Biden Administration that have influenced them.

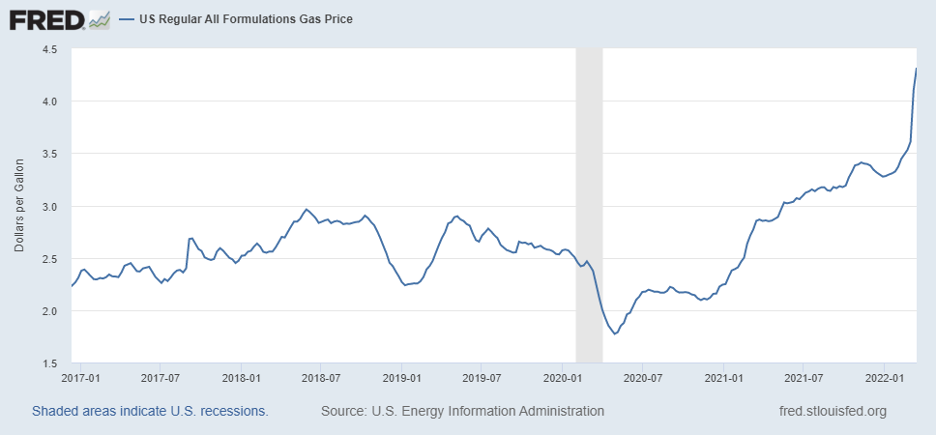

The truth is that gas prices have been steadily increasing since President Biden took office, and President Putin’s declaration of war upon Ukraine is merely a contributing factor to market uncertainty and surging prices (see chart below). This is made clear when looking at the evolution of gasoline prices under President Biden in relation to Russia’s invasion of Ukraine.

Between President Biden’s inauguration in January 2021 and October 2021—one month before Russia began to surge troops on its border with Ukraine — gasoline prices increased 46 percent. The ensuing months witnessed modest price fluctuation before topping off at $3.50. This brings us to the market’s reaction to Russia’s invasion of Ukraine on February 24, 2022, when gasoline prices demonstrated a 23 percent increase in March. This increase represents just half of the inflationary costs brought about by President Biden’s policies in the absence of geopolitical turmoil.

Furthermore, the statements by President Biden and his administration that shifted price-related blame at the feet of gas retailers can be seen as nothing more than an effort to avoid responsibility for the economic impact of record government spending and aggressive climate-related policies. After all, President Biden also called for investigations into collusion and price gouging on the part of the oil and meat industries. The recent push by the Biden Administration to have the Federal Trade Commission investigate retail gasoline pricing activity comes as no surprise. In fact, current overall inflation is more directly attributable to the rapid expansion of federal spending programs, like the American Rescue Plan Act, and the aggressive implementation of climate-oriented policies.

The Origins of Market Turmoil—A Pandemic and a President

During the pandemic in 2020, global oil demand fell approximately 9 million barrels a day (mb/d) relative to pre-pandemic 2019 levels. The United States alone experienced an 11 percent decline in production in 2019, representing an all-time high of 12.23 mb/d. The pandemic’s negative impact, including a collapse in global demand of approximately 30 percent, meant producers faced a wholly different forecast. Storage facilities quickly filled up, and off-takers of excess oil were increasingly difficult to identify. For the first time in history, U.S. month-ahead oil sales went negative and risked bringing the industry to its knees.

International Energy Agency (IEA) Oil Demand Forecast

Source: International Energy Agency

The International Energy Agency (IEA), an organization of energy-consuming nations founded in response to the initial energy crisis of the 1970s, projects that “global oil consumption is projected to reach 104.1 mb/d” by 2026. That is nearly 4.5 mb/d higher than pre-pandemic levels, and spare capacity is currently constrained.

Rather than anticipating a recovery in global oil demand and promoting policies that empower industry to meet demand scenarios, the Biden Administration used the opportunity to institute climate brinksmanship — utilizing a global energy crisis to advocate for a more rapid energy transition. This approach further undermined the ability of the U.S. oil producers to freely operate as swing producers during periods of lower production, specifically from OPEC+ countries, and high price incentives. The Biden Administration’s efforts to address these concerns, namely the repeated releases from the Strategic Petroleum Reserve (SPR), have three times now proven ineffective in alleviating pressures. In the absence of comprehensive policy changes, such releases only undermine the core function of strategic stockpiles. Put simply, President Biden’s policies have created heightened levels of uncertainty for investors and developers, compounding the recessionary trends stemming from the pandemic.

Russia & Global Oil Markets

Russia is the third-largest oil producer globally, with a total oil output of 11.3 million barrels a day (mb/d)— roughly 10 percent of the 97 mb/d global demand. Russia’s war on Ukraine has had a profound impact on the global oil market, leading to what could be the most significant energy crisis since the 1979 Oil Shock. Initially, the International Energy Agency (IEA) in late February stated that Russia’s invasion of Ukraine “has as of yet not resulted in a loss of oil supply to the market.” While this was true in terms of availability, market shocks resulted from anticipated sanctions upon Russia’s energy sector, which have still yet to be fully agreed upon or enacted, and the voluntary shunning of Russian oil by Western companies and traders. As time progresses, there is a mounting risk of further disruption and, consequently, further price increases stemming from Russia’s invasion. The IEA assesses that there is the potential for a loss of some 3 mb/d as sanctions on Russia’s financial sector set in and carry implications on the ability of Russia to conduct oil transactions or receive new investments. As sanctions directly targeting Russia’s energy sector are increasingly considered, there will undoubtedly be more significant consequences for global growth projections, supply, and consumer costs. Russia exports some 8 mb/d of oil and refined products, including 5.5 md/d of crude oil, most of which is exported to markets in Europe and Asia. While Europe is expected to taper off its imports of Russian oil, a vital component of a new 5-year strategy, Asia will likely continue to present a key market for Russian oil. The plummeting prices of Russian oil, given the general political unattractiveness of these resources, have attracted high-demand off-takers. This is the case with India and China. They either seek to take advantage of low energy prices, as is the case of India, or, in the case of China, prop-up Russia’s petroleum sector, given its current role as the second-largest single market for Russian exports.

If the West were to implement sanctions directly upon Russia’s energy sector, including the enforcement of secondary sanctions--the enforcement of prohibited transactions among non-U.S. persons and companies — to offset the momentary attractiveness of depressed Russian oil prices, the result could be a loss of as much as 3 mb/d of oil to global markets from Russia. The ability of markets to weather such a possible loss is undercut by a reluctance to encourage more significant investment into western associated fossil fuel operations, which underscore the national security ramifications of underinvestment, not to mention the economic ramifications. Furthermore, consideration should be given to Russian efforts to evade sanctions by “going dark,” a process that involves turning off naval transponders to avoid tracking or conducting cargo swaps at sea to disguise the origin of oil volumes. Reports indicate that this is already occurring.

In Search of a Solution—A Mitchell Plan, Not Marshall Plan

Geopolitical instability had previously been recognized as a constant in both foreign policy and domestic energy policy, not an outlier, and fossil fuels are universally understood to play the primary role in the global energy markets well through 2050. However, the Biden Administration continues to overlook these factors, instead preferring to pursue the resources of unstable and adversarial producers and double down on a rapid energy transition.

President Biden’s preference to seek alternative supplies in the form of Iranian and Venezuelan oil will no doubt face both political and technical challenges. While Iran does offer relief for global markets by adding an estimated 1.7 mb/d, this will require a waiver of sanctions and the removal of the Iranian Revolutionary Guard Corps (IRGC) from its current designation as a terrorist organization. Venezuela, for its part, recorded 788,000 b/d of production in February 2022, and current estimates point to Venezuela being able to increase output close to 1 mb/d. However, these production estimates are dubious as Venezuela has suffered from years of underinvestment in and sanctions on its oil sector. China serves as both Iran’s and Venezuela’s largest market, and in 2021 it is estimated that, despite U.S. sanctions on both countries’ oil exports, China imported approximately 324 million barrels from these countries, a 53 percent increase.

The Biden Administration is unlikely to distance itself from its ambitious “green” targets. However, the administration can still adjust to a more balanced approach that couches policy objectives with the reality of current inflation, one-quarter of which is the result of energy price inflation, not to mention the critical function of petroleum products in everyday life. The recent call by Secretary of Energy Jennifer Granholm to develop a “Marshall Plan for clean energy in 2022 and beyond” threatens to add significant stressors to an already struggling global economy by promoting greater levels of government spending. Furthermore, such efforts signal to capital markets that fossil energy is not a viable long-term investment strategy, particularly at a time when such investment is most critical. The more appropriate action would be to develop a strategy resting on an unhindered free market. George P. Mitchell, the pioneer who kick-started the shale revolution, rather than George C. Marshall, represents a more applicable standard.

Resting on the foundation of innovation and free markets, such a plan should see policymakers prioritize efforts that empower free-market actors to ensure the world has enough affordable and reliable energy supplies, namely from the United States. High oil prices offer the most significant enticement for increased production, but there is still the risk of outsized regulatory hurdles that impose artificial limitations on output. The United States ranks among the world’s leaders in technically recoverable shale, estimated at 58 billion barrels of oil and 665 trillion cubic feet (tcf) of natural gas. Secretary Granholm called for “industry to ramp up production, where and whenever they can,” and to do so, we should recognize the contribution of American independents and majors alike in unleashing the potential of these resources. Perhaps the most effective means of ensuring this outcome is for President Biden to waive burdensome emissions-related regulations imposed under his administration. U.S. shale oil and natural gas producers are the most capable of increasing production in the United States, but they are also the most at risk of succumbing to federal red tape. Creating market certainty for producers, developer, and exporters through permitting and regulatory reform will go far in alleviating near term pressures, but such measures must also be implemented with an eye toward long term market stability and growth.