Runaway Inflation and The Big Government Socialism Bill

KEY TAKEAWAYS:

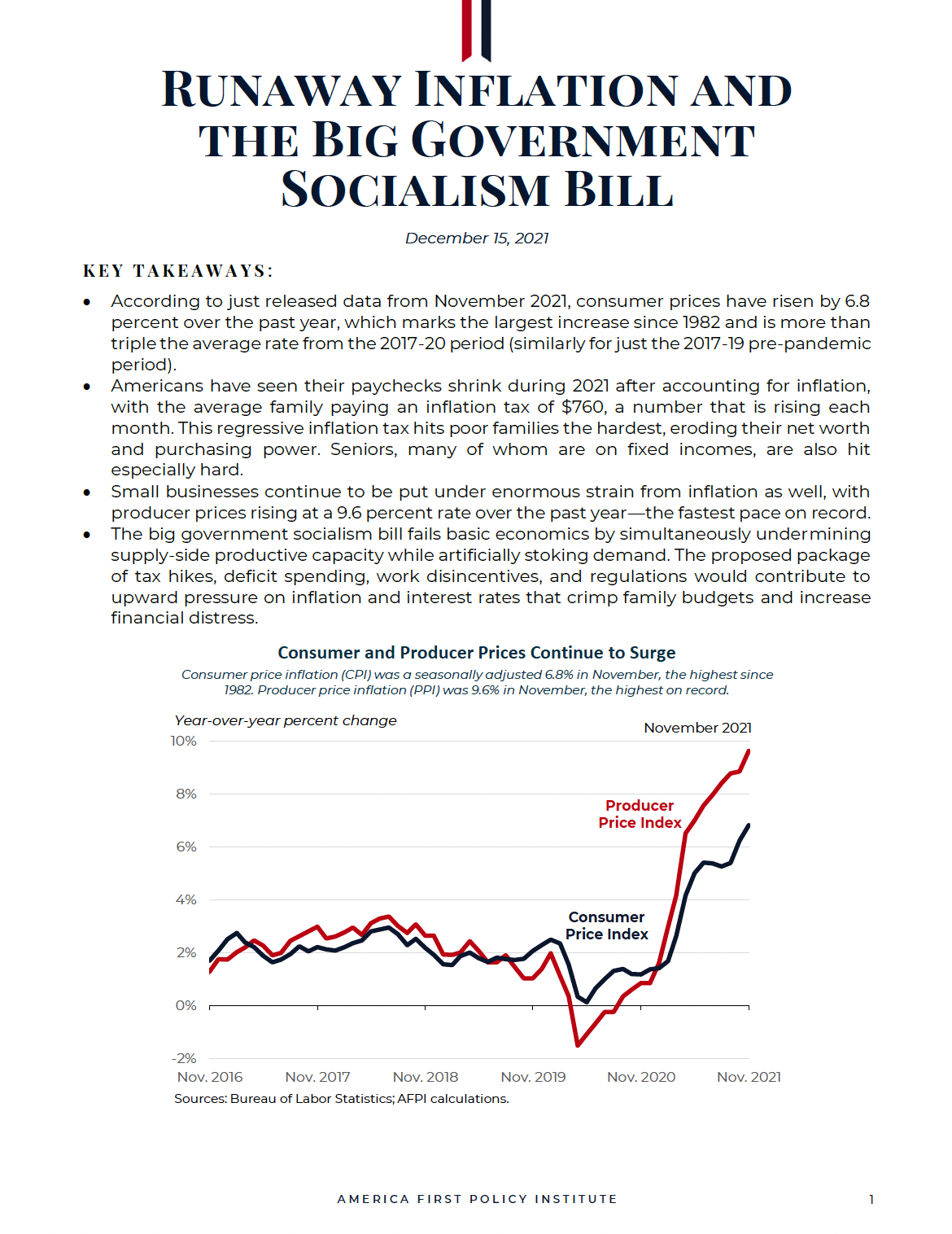

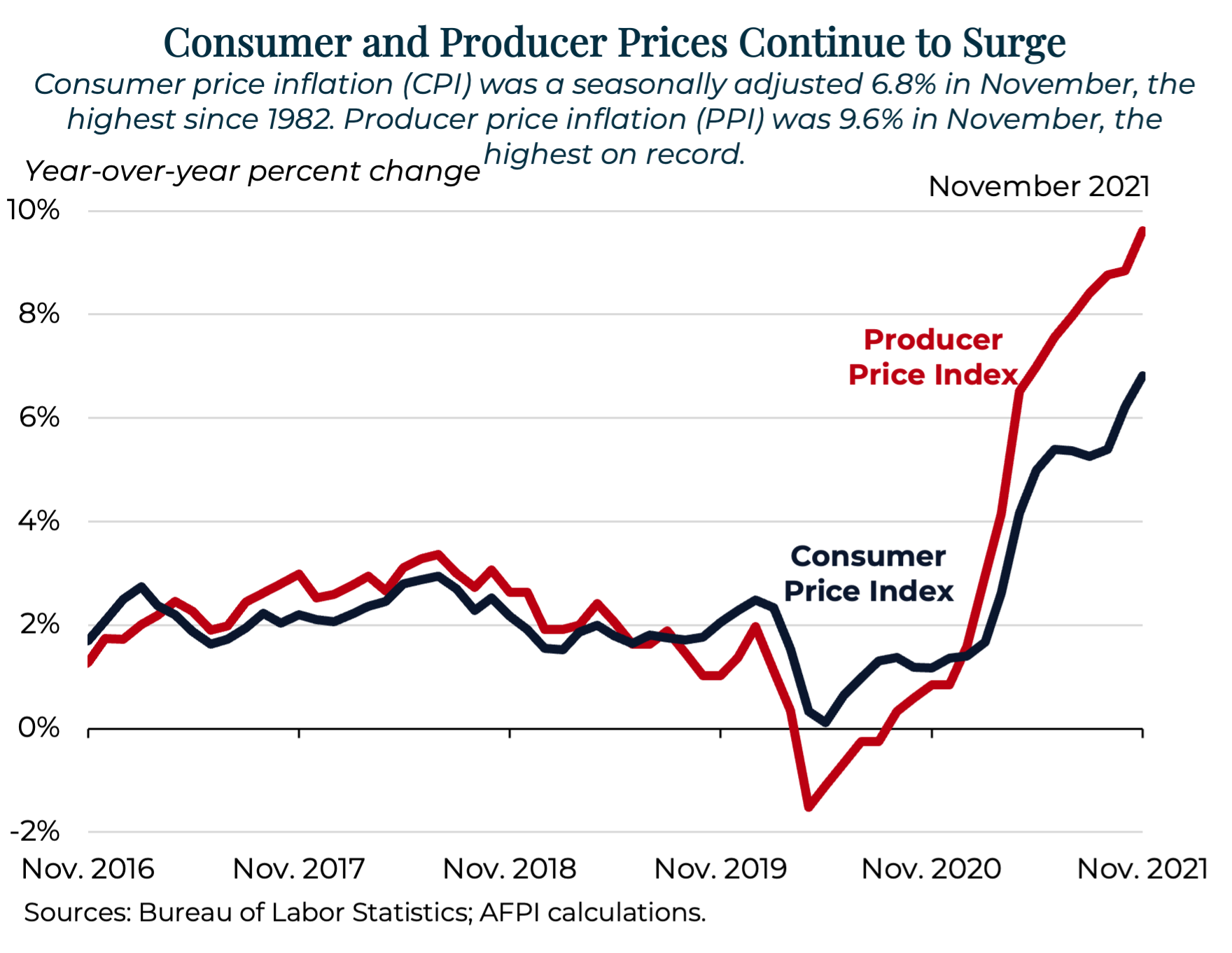

- According to just released data from November 2021, consumer prices have risen by 6.8 percent over the past year, which marks the largest increase since 1982 and is more than triple the average rate from the 2017-20 period (similarly for just the 2017-19 pre-pandemic period).

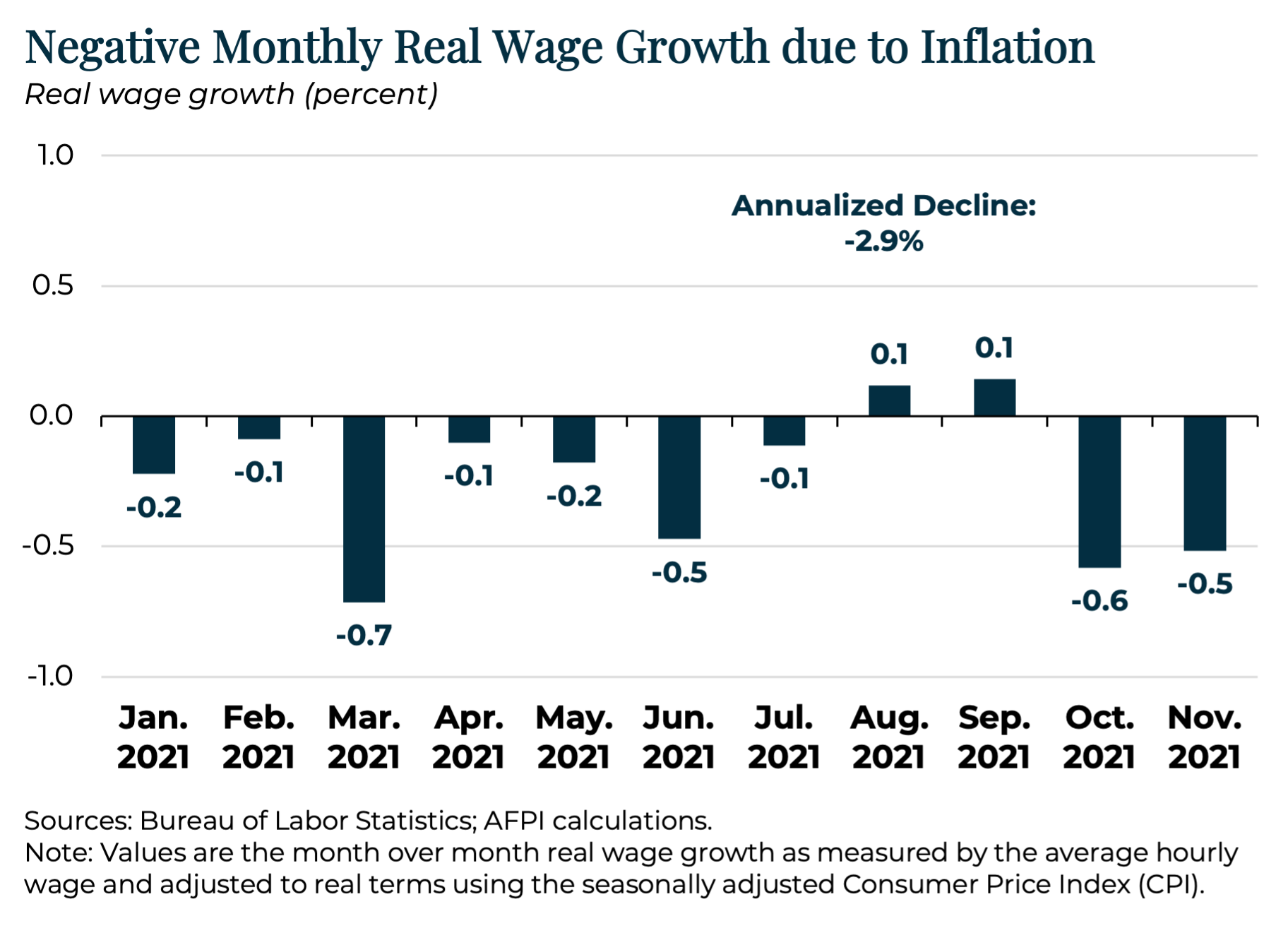

- Americans have seen their paychecks shrink during 2021 after accounting for inflation, with the average family paying an inflation tax of $760, a number that is rising each month. This regressive inflation tax hits poor families the hardest, eroding their net worth and purchasing power. Seniors, many of whom are on fixed incomes, are also hit especially hard.

- Small businesses continue to be put under enormous strain from inflation as well, with producer prices rising at a 9.6 percent rate over the past year—the fastest pace on record.

- The big government socialism bill fails basic economics by simultaneously undermining supply-side productive capacity while artificially stoking demand. The proposed package of tax hikes, deficit spending, work disincentives, and regulations would contribute to upward pressure on inflation and interest rates that crimp family budgets and increase financial distress.

After hitting a thirty-one year high in October, the inflation rate outdid itself in November by reaching a thirty-nine year record of 6.8 percent. Not since 1982 have prices risen at so rapid of a rate, but unlike in 1982, when inflation was rapidly coming down from a double-digit peak, the rate of inflation in 2021 has been continuously on the rise for almost the entire year with no signs of abating. Small businesses are also suffering from rapid price increases, with the producer price index recording a 9.6 percent increase year-over-year, which is the fastest on record. The Federal Reserve has even abandoned its use of the term “transitory” to reference the duration of inflation, and the Bureau of Labor Statistics (BLS) has disproven the canard that the inflation American families are seeing right now is confined to a handful of sectors. To the contrary, the BLS inflation report states that “the increase was the result of broad increases in most component indexes, similar to last month.” In other words, prices are more or less rising across the board. Looking at basic needs, food prices have risen by 6.1 percent over the past year, while energy costs are up over 33 percent. The figure above makes evident the rapid run-up in prices that accelerated after the passage of the American Rescue Plan Act in March 2021, which has been felt both by consumers (the consumer price index) and by businesses (producer price index). While the Biden administration has resorted to putting all the blame for inflation on the pandemic instead of on its own policies, inflation is considerably higher in the U.S. than in the majority of OECD countries. In addition, the OECD forecasts that U.S. inflation will be more than double that of the EU in 2022Q1.

The impact of rising inflation on family finances is dramatic. In almost every month of 2021, the inflation rate has exceeded nominal wage growth, leading to a decline in real wages. The erosion of purchasing power has delivered nearly a three percent pay cut to American workers. Even more ominously, the pace of inflation and real wage declines has increased dramatically over the past two months instead of showing signs of reprieve. All told, the average American family has paid an inflation tax of $760 in lost purchasing power over the past year, and this number goes up with each passing month. As discussed in an earlier AFPI research paper, families at the lower end of the income scale are especially vulnerable to inflation. Perhaps most vulnerable of all are the millions of seniors living on fixed incomes who must watch their pensions erode in value while in many cases having little recourse—particularly in cases of bad health—to generate additional sources of income from working. All told, these inflation costs demonstrate that households with income well under $400,000 have already experienced a sizable tax hike even before considering the Build Back Better bill—more aptly titled the big government socialism bill—currently under consideration by Congress that would likely exacerbate supply chain bottlenecks, worker shortages, and artificially stoke demand, thereby adding to inflationary pressures.

Whereas the decisive federal relief provided in 2020 was designed with a specific purpose in mind—to support families and small businesses through the worst of the pandemic and to lay the foundation for a robust recovery to the pre-pandemic prosperity that was delivering record low poverty and unemployment and record high income growth—the big government socialism bill appears to be designed with one aim: to transform America. It would make government relief a lifestyle instead of a lifeline, it would overturn a twenty-five year consensus regarding the necessity of work requirements as a condition for receiving aid from hardworking taxpayers, and it would further extend the interfering hand of government bureaucrats into Americans’ daily lives, affecting everything from how they get childcare to the vehicles they drive to get to work.

THE FAILED ECONOMICS OF THE BIG GOVERNMENT SOCIALISM BILL

Basic economics teaches us that increases in demand cause prices and output to both rise. However, when accompanied by decreases in supply, prices rise by even more while the gains to output are reversed, at least in part and potentially entirely. When applied to the economy as a whole, the result is stagflation: low growth coupled with high inflation. If the goal is rapid growth and stable prices, expanding supply—that is, the productive capacity of the economy—is paramount. Consider the federal response in 2020 to COVID-19 as a case in point. The economic impact payments and temporary unemployment benefits helped stabilize family finances and boost demand, but these policies were accompanied by programs like the Paycheck Protection Program and Employee Retention Tax Credit that increased supply by preventing a wave of business failures and strengthening labor market attachment between workers and employers to aid a swifter return to work. The result: the U.S. economy rebounded with record-setting employment and GDP gains throughout summer 2020 and a continued steady recovery in job rolls throughout fall 2020, all while inflation remained stable. Unfortunately, the DNA of the big government socialism bill consists of artificially stoking demand through deficit-financed government subsidies that pick winners and losers in the market while simultaneously undercutting supply. This philosophy can be seen throughout the bill, form its raft of tax hikes to its approach to overregulating and distorting the child care sector.

The American Rescue Plan Act (ARPA) passed in March 2021—after which point inflation started taking off—offers a preview of the damaging effects of the big government socialism bill. The ARPA spent $1.9 trillion in ways that discouraged work by extending overly generous unemployment benefits that paid workers more to remain jobless than to work and removing work requirements from the child tax credit. In essence, the ARPA gave America a glimpse of a world with universal basic income where people can consume economic resources without contributing to their production. It should thus not be surprising that inflation has skyrocketed in the wake of ARPA’s passage. Even Larry Summers, the Treasury Secretary under President Clinton, called the Biden Administration’s fiscal policy “the least responsible macroeconomic policies we’ve had in the last 40 years.

HOW THE BIG GOVERNMENT SOCIALISM BILL WOULD ARTIFICIALLY STOKE DEMAND AND LIMIT SUPPLY

At its core, the big government socialism bill seeks to spend $5 trillion in additional government programs over the next ten years. One of the largest elements of the spending bill is an extension of the aforementioned child tax credit, whereby parents can receive $3,000 per child aged 6 to 17 and $3,600 for children aged 5 and under, all without any requirement that the parents have any earnings or are even looking for work. According to a recent letter by the Congressional Budget Office, extending the child tax credit for ten years will increase the deficit by $1.6 trillion over the next ten years. Helping parents with the rising cost of raising a family is a laudable goal, and to that end the Trump Administration increased the child tax credit amount from $1,000 to $2,000. But removing the expectation of work undermines this goal in the long run. In recent research released by the National Bureau of Economic Research, a team of University of Chicago economists found that the removal of work requirements in the Biden child tax credit expansion will drive an estimated 1.5 million workers out of the labor force and therefore not make a dent in deep child poverty. The bottom line of this policy is that this proposal would pour more than a trillion dollars going into household checking accounts to be spent on economic output while lowering the number of workers available to help produce that output, thereby contributing to inflationary pressures.

The second largest cost over a full ten-year period of the big government spending bill is the provision for childcare and pre-kindergarten instruction. The CBO estimates the ten-year cost of this provision at $752 billion. The Biden Administration touts this spending as an investment in “human infrastructure” that would alleviate, rather than fuel, inflation. However, another recent study finds that the combination of government subsidies that fuel demand and extensive regulations that would shut out many current providers from the child care market would drive up family childcare costs by anywhere from 80 to 120 percent. In other words, all of this “investment” ends up fueling higher prices.

Lifting the cap on the State and Local Tax (SALT) deduction from its current $10,000 to over $70,000 would also contribute to anti-growth and inflationary pressures while delivering a windfall to wealthy Americans living in expensive coastal cities with spendthrift state and local governments. To put the current $10,000 cap in perspective, if state income tax rates are five percent, one would have to make more than $200,000 in taxable income to have more than $10,000 in state income taxes. According to a recent analysis by the non-partisan Committee for a Responsible Federal Budget, households earning under $100,000 would receive less than 2.5% of the benefit at the same time that hundreds of billions of dollars would accrue in federal deficits as a result of lifting the cap. The big government socialism bill SALT giveaway would also inflate already rapidly rising housing prices—pushing homeownership further out of reach for millions of Americans—and create an incentive for state and local governments to raise taxes—thereby further constraining the supply-side of the economy and contributing to inflationary pressures because the cost of those tax hikes would be partly borne by federal taxpayers across the country who would be unable to vote against them. Union boss Randi Weingarten has admitted as much, stating that lifting the SALT cap “…puts the incentive system back in place to invest in localities…” where, naturally, “invest” means state and local governments spending more money—not just from their own constituents, but from Americans nationwide who would subsidize those tax hikes through their own federal taxes.

All else equal, increases in tax rates reduce the willingness of the private economy to make investments in new capital and stifles the creation of new jobs. Higher taxes reduce the amount businesses have to invest in new products, greater capacity for existing services, or improvements in product quality. Additionally, tax-induced reductions in future cash flows from these investments stifle the willingness of private capital to make new investments. With less money flowing towards innovation and slower growth in the capital base, there is less domestic capacity to meet the demand Americans have for goods and services. Either the American people will pay higher prices or this additional demand will instead be served by foreign imports. In other words, the big government socialism bill proposes to borrow trillions of dollars to incentivize the purchase of foreign goods. Higher prices without increased domestic production results in stagflation.

Simultaneously, the proposal provides even more money for green energy boondoggles. According to the US Energy Information Administration, prior to the pandemic, the US obtained energy independence for the first time in 67 years. The Biden Administration has increased the cost of extracting US sources of energy, canceled the Keystone XL pipeline to carry North American sources of energy, and instead seeks to increase massively our reliance on China for electric car components and critical inputs throughout renewable energy supply chains. The big government socialism bill doubles down on such foolishness by sending even more resources towards green energy projects (remember Solyndra) and sending a message to traditional energy providers that they should not increase domestic capacity. Over the last year, the price of a gallon of gasoline has increased 55 percent (from $2.16 per gallon to $3.34) and nothing in the massive spending bill will assist in reducing the cost to fill our cars with gas. Such prices not only directly increase costs for consumers, nearly every good in our economy requires transportation, and higher prices of gasoline increase the price of all goods.

The list of demand-inducing and supply-constraining provisions in the big government socialism bill goes on and on, and they could not come at a worse time for the economy. As discussed previously, inflation is at a nearly four decade high, and there are millions more job openings than there are Americans look for work. Specifically, there were 11 million job openings in October 2021, and yet employment is still 7.8 million jobs short of the pre-pandemic trend. The big government socialism bill has the potential to make these labor shortages permanent. Casey Mulligan at the University of Chicago estimates that, overall, the bill would reduce full-time equivalent employment by about 7 million jobs. Of course, public sector job rolls would see no such decline, with the bill inflating the ranks of IRS personnel, climate activists, and bureaucrats inhabiting the vast regulatory apparatus of the federal government.

CONCLUSION

By retiring the phrase “transitory” from the public discussion over rampant inflation, rhetoric has finally caught up to reality. While it is within our power to implement sound fiscal, monetary, and regulatory policies to expand supply and reduce inflation, the big government socialism bill promises more of the same, but on steroids. Artificially creating greater demand while erecting hurdles to supply can only lead to one thing: rising prices. For much of 2021, Americans have struggled under the burden of shrinking paychecks and a stealthy inflation tax that has taken nearly $800 out of family wallets. Introducing even more spending, taxes, and regulations would only be adding to these inflationary pressures, with the result either being a sustained rise in inflation that extends even further into the future than currently forecasted or more aggressive action by the Federal Reserve to contain it by raising interest rates, leading to higher living costs of a different kind for struggling families. Either way, Americans cannot afford for this to become the new normal.